Abstract

Within the framework of the United Nations' 2030 Agenda, this study analyzes the role of the energy sector in achieving the Sustainable Development Goals (SDGs). Through a resource-based approach, it investigates the elements facilitating SDG implementation in global energy companies, distinguishing between renewable energy and fossil fuel firms. Using empirical analysis with data from 522 companies in the sector, the methodologies of Partial Least Squares Structural Equation Modeling (PLS-SEM) and Qualitative Comparative Analysis (QCA) are combined to understand the factors driving SDG implementation in this industry. The results reveal significant differences between renewable energy and fossil fuel companies regarding the effectiveness of facilitative elements, highlighting the complexity of implementing SDGs in the energy sector. This study contributes to understanding how energy companies can leverage their resources and capabilities to align with the 2030 Agenda, providing guidance for change agents in the energy transition.

1. Introduction

The United Nations’ (UN) 2030 Agenda for Sustainable Development, consisting of 17 interconnected Sustainable Development Goals (SDGs) and 169 targets, has placed significant pressure on all sectors and firms to prioritise sustainability (Gusmão Caiado et al., 2018; UN, 2015). Since they are major forces behind economic development, industrial firms have an obligation to protect the environment (Chen et al, 2024). At the half-way point of the 2030 Agenda for Sustainable Development, the 2023 Global Sustainable Development Report (GSDR) assessed progress on SDGs. We could find that most other targets are either at a moderate distance to the goalpost or far from it. So, there is an ever-greater urgency to build momentum, embrace solidarity, and speed up progress on the SDGs, which calls for decision-makers to take a systematic and strategic approach to drive and accelerate the transformations. Such pressure is particularly pronounced in the energy sector, where the imperative to transition towards sustainable practices and technologies is predominant due to its critical importance towards environmental sustainability and societal growth. The sector is a major contributor to greenhouse gas emissions and climate change, not only causing far-reaching consequences for the environment, and also having an important effect on society, given that it supplies the necessary power for daily life worldwide and economic growth (IEA, 2022; Kud et al., 2021).

To respond to these issues, the 2030 Agenda addresses specific SDGs related to the sector, namely affordable and clean energy (SDG 7), climate action (SDG 13) and sustainable cities and communities (SDG 11) (Fuso Nerini et al., 2017). Considering that global firms have been declared vital partners for the achievement of global sustainable development, it becomes imperative that firms in the sector align with the 2030 Agenda (Chan et al., 2020; Kolk, 2016; Montiel et al., 2021; Rashed & Shah, 2021).

Specifically in the energy sector, firms are increasingly focusing on implementing SDGs through the adoption of Corporate Social Responsibility (CSR) initiatives (Song et al., 2022). These initiatives guide and enable energy firms to integrate sustainability principles at the enterprise level, directly impacting sustainable energy development at local and national levels (Battaglia et al., 2020). However, prior research on the topic of SDG implementation suggests that there are significant differences within the energy sector in terms of the sustainability performance of renewable energy and fossil fuel firms. In short, renewable energy firms appear to demonstrate a higher environmental performance effort and have a stronger focus on sustainability and energy efficiency compared to fossil fuel firms (Langnel & Amegavi, 2020; Zhang, 2018). Further, the literature on this subject remains largely focused on a country level (Kumar, 2014; Raquiba & Ishak, 2020). This limited global context indicates a need for broader geographical coverage in research that considers the notable differences between sub-sectors in the energy industry.

The study objective is to understand the nature of the enablers that explain SDG implementation in global firms in the energy industry, under the umbrella of the resource-based view (RBV) perspective, as it provides a valuable framework for understanding how firms can achieve and sustain competitive advantage through their internal resources and capabilities (Barney, 1991). Two research questions guide the study in achieving its objective. The first is “Which enablers better explain SDG implementation in energy sector firms?” This question facilitates comparability to past research findings in other sectors. The second research question is “What combination of these enablers better explains SDG implementation in energy sector firms?”. Based on these questions, the study explores how the complexity of firm resources influences SDG implementation in global firms by addressing the enablers that facilitate this implementation. It also addresses the fact that these enablers are interconnected and not solely independent.

To address the first research question, a quantitative approach was employed, utilising Smart PLS 4 (Ringle et al., 2022) for a bootstrap procedure (Efron, 1982; Hesterberg, 2011). The second research question was tackled by means of a qualitative comparative analysis (QCA), employing fuzzy-set QCA (Ragin, 2009). Through combining the quantitative and qualitative approaches, the research aims to gain a nuanced understanding of the key enablers that better explain a higher implementation of SDGs in energy sector firms. A database retrieved from the 2021 Refinitiv Eikon database was used for both analyses.

The rest of the document is structured as follows: Section 2 encompasses the literature review and theoretical framework; Section 3 details the methodology; Section 4 presents the results derived from the research conducted, followed by a discussion in Section 5. Last, Section 6 contains the conclusions and theoretical and practical implications of the analysis.

2. Literature review

2.1. Theoretical Framework (RBV)

The resource-based view (RBV) posits that an organisation’s competitive advantage is a function of the strategic resources it possesses. The principle of the theory is that resources that are valuable, rare, non-substitutable and inimitable, together with the capability to dynamically re-configure these resources, is more likely to produce superior rates of return (Barney, 1991; Grant, 1991). The theory states that by focusing on inimitable attributes and leveraging resources effectively, firms can position themselves for long-term success in dynamic and competitive environments.

The origins of the resource-based view theory can be traced back to the works of early scholars such as Penrose (1995), Grant (1991), Wernerfelt (1984) and Peteraf (1993), later to be shaped by interdisciplinary influences from fields such as economy, sociology, psychology and environmental studies (Barney, 2001; Hart, 1995). Recent extensions of Hart's (1995) RBV-oriented research resulted in the development of the natural resource-based view (NRBV) of the firm, which emphasised the need for firms to develop their competitive advantage while considering the constraints imposed by the natural or bio-physical environment. The NRBV proposes four strategic capabilities that could lead to sustainable competitive advantage: pollution prevention, product stewardship, clean technologies and base of the pyramid. The theory posits that by developing valuable, rare, inimitable and non-substitutable resources related to these environmental strategies, firms can achieve both sustainability and competitive advantages (McDougall, et al. 2019). Both the RBV theory and its extension, NRBV, have been applied in various contexts, including the implementation and reporting of SDGs in different types of firms. For instance, Valbuena-Hernandez & Ortiz-de-Mandojana (2021) emphasised the role of effective strategic partnerships in encouraging corporate sustainability, aligning with the broader objectives of SDG implementation and reporting in listed firms. Conversely, in small firms, Roxas et al. (2016) drew from the NRBV theory to study a sample of 212 firms, finding that having an environmental sustainability orientation benefits firm performance. Hu & Hung Kee (2021) discussed the use of digitalisation, and particularly information and communications technologies (ICTs), in achieving sustainable development goals, indicating the relevance of RBV in the context of technological advancements and sustainability. Therefore, both have been influential in linking environmental management to firm strategy and performance and applied when discussing the implementation and reporting of SDGs in different types of firms.

For instance, Valbuena-Hernandez & Ortiz-de-Mandojana (2021) emphasised the role of effective strategic partnerships in encouraging corporate sustainability, aligning with the broader objectives of SDG implementation and reporting in listed firms. Conversely, in small firms, Roxas et al. (2016) drew from the NRBV theory to study a sample of 212 firms, finding that having an environmental sustainability orientation benefits firm performance. Hu & Hung Kee (2021) discussed the use of digitalisation, and particularly information and communications technologies (ICTs), in achieving sustainable development goals, indicating the relevance of RBV in the context of technological advancements and sustainability.

2.2. Reporting and sustainability in the energy sector

Reporting, understood as the disclosure of non-financial results by firms, has been growing steadily in recent years, in terms of both Environmental, Social and Governance (ESG) and SDG reporting, either because it creates value for stakeholders or because of institutional pressures (Rosati & Faria, 2019a, 2019b).

Although the practice of reporting is relevant across all sectors, it is crucial to firms in the energy sector as they are under increasing social pressure to reduce their environmental impact, support sustainable development and address pressing concerns such as monopoly power, corruption and social inequalities (Makridou et al., 2023), all of which are obstacles that the industry must overcome to achieve SDGs. With these expectations, Corporate Social Responsibility (CSR) has become increasingly important in the sector (Adamkaite et al., 2023), not only to improve investment opportunities and increase reputation but also to be more resilient in crises (Mattera & Soto, 2023; Zhang et al., 2023).

According to The Refinitiv Business Classification (Reuters Group, 2020), the economic sector for energy firms is comprised of three business sectors, namely (1) fossil fuels, (2) renewable Energy, and (3) uranium. The whole sector plays a crucial role in environmental impact, with significant differences between each business sector. In general terms, firms are under increasing pressure to expand their generation of green energy due to the growing belief that renewable energy production can benefit the environment and drive economic growth (Makridou et al., 2023; Paramati et al., 2017; Roy & Das, 2018). Framing this within the context of the NRBV framework, it directly aligns with the capability of clean technologies.

While there are inconclusive results regarding the sustainability performance of fossil fuels firm, there is intense discussion about the role of fossil fuels in climate change, prompting these firms to improve their environmental policies and performance (Gonenc & Scholtens, 2017; Kolk & Levy, 2001). In their analysis on the environmental and financial performance of a large sample of international firms during the period 2002-2013, Gonenc and Scholtens (2017) found that fossil fuel firms score significantly higher on environmental performance efforts than other firms, suggesting that these firms are striving to improve their environmental performance, possibly in response to the increasing pressure to address environmental concerns. Within the NRBV framework, this is directly linked to the capability of pollution prevention.

Conversely, studies exploring the sustainability performance of renewable energy firms seem to be more conclusive, with the vast majority of papers recognising renewable energies such as wind and solar energy as more sustainable alternatives (Langnel & Amegavi, 2020; Zhang, 2018), suggesting that firms do not need to prove their positive sustainable performance. However, it is important to note that authors such asThis aligns directly with the product stewardship capability within the NRBV framework, emphasizing the responsibility of the firm’s activity for the entire product or service lifecycle. Gasparatos et al. (2017) have pointed out that the development and operation of novel renewable energy infrastructures may negatively impact ecosystems and biodiversity.

Regarding uranium, its mining, extraction, processing and operations in its nuclear power plants have been linked to environmental pollution, particularly in soil and groundwater, as well as long-term potential environmental hazards due to the element’s chemical and radiological toxicity (Yin et al., 2015; Zhang et al., 2020). Efforts to drive firms towards sustainability performance call for significant changes in the focus of manufacturing firms, particularly concerning the triple bottom line dimensions of economic, environmental and social impacts (Abdul-Rashid et al., 2017).

The reviewed papers suggest that there are differences in sustainability performance and reporting practices between fossil fuels, renewable energy and uranium firms, with these notable differences urging researchers to analyse them separately. In summary, while fossil fuel firms are striving to improve their environmental performance, renewable energy firms are seen as more sustainable alternatives, despite their facing unique financial challenges and potential negative impacts on ecosystems and biodiversity.

2.3. Enablers to implement SDGs

Following the terminology of Palau-Pinyana et al. (2023), the resources that facilitate a better implementation of SDGs are considered as enablers, which should be understood as resources firms across all sectors can utilize to gain competitive advantage, under the umbrella of RBV. These enablers encompass a wide array of organisational, strategic and operational aspects that can facilitate the implementation of the goals, such as having a larger size, having higher environmental innovation scores through the adoption of circular and sharing economy, and utilising new green technologies (Bukalska et al., 2021; Rosati and Faria, 2019a). Additionally, in terms of governance, having a higher share of female directors is an aspect that can play a pivotal role in fostering SDG implementation (Rosati and Faria, 2019a). Further, higher commitment to sustainability frameworks such as Quality Management Systems (QMS) and engaging specific stakeholders, such as employees, in the operations (Rosati and Faria, 2019a) can also enable the implementation of SDGs.

The first enabler identified is having a larger size. Several authors concur that a larger firm size positively influences the level of engagement for sustainability-oriented strategies and practices, as well as sustainability reporting (Darnall & Edwards, 2006; Fitjar, 2011; Gallo & Christensen, 2011). When comparing with small and medium enterprises (SMEs) the reasons behind larger enterprises showcasing a greater engagement to society and to the planet may be: (i) related to a larger number of resources to promote sustainability, (ii) due to being more exposed to public pressures that demand so, or (iii) because of having more knowledge on sustainability management tools (Brammer & Pavelin, 2006; Hörisch et al., 2015). Thus, the following proposition is formulated:

P1 : Larger firm size is associated with higher SDG implementation in the energy sector.

Innovation has been shown to be a key driver in the corporate implementation of SDGs (Cordova & Celone, 2019). While various forms of innovation exist—such as business model, product, and process innovation—research suggests that firms adopting environmental innovations to mitigate risks, reduce pollution, and minimize negative impacts are better positioned to enhance corporate sustainability (Calabrese et al., 2018; Imaz & Eizagirre, 2020; Olfe-Kräutlein, 2020; Taminiau et al., 2017). Companies across sectors are embracing these innovations by adopting circular and sharing economy models and integrating green technologies (Bukalska et al., 2021; Rosati & Faria, 2019a). To assess the extent of innovation as an enabler within the energy sector, the following proposition is advanced:

P2 : More innovative firms are associated with higher SDG implementation in the energy sector.

Additionally, in terms of governance, considering the gender diversity in the board of directors is another factor that can influence the level of corporate sustainability commitment. Specifically, literature on the composition of the board of directors indicates that a higher share of female directors can enhance board effectiveness, is related to a higher level of SDG implementation and can promote environmental initiatives (Muhammad & Migliori, 2022; Rosati & Faria, 2019a). Other recent literature emphasizes the relevance of female directors in firms and finds a relationship between women participating on corporate boards and sustainability reporting (Girón et al., 2022). Further, Velte (2022) and Biswas et al. (2018) conclude that gender board diversity is an important variable in positively influencing both corporate social responsibility and environmental outputs. With that in mind, proposition 3 is advanced:

P3 : Firms with more gender diversity are associated with higher SDG implementation in the energy sector.

Further, in a study involving data from 408 organizations worldwide, Rosati and Faria (2019) identify a relationship between firms that have external assurance and the level of Sustainable Development Goal (SDG) implementation. Consequently, organizations with international standard certifications related to management practices, such as Quality Management Systems (QMS) and Total Quality Management (TQM), can establish a solid foundation for aligning their activities with corporate sustainability (Pawliczek & Piszczur, 2013; Wang et al., 2016). To evaluate this in the energy sector, Proposition 4 is formulated:

P4 : Firms with external assurance are associated with higher SDG implementation in the energy sector.

Another critical factor for successful SDG implementation is the involvement of the firm’s departments and stakeholders, particularly employees, in the firm’s operations and voluntary work (Rosati & Faria, 2019a). Westerman (2021) argues that the Human Resources department is particularly well-suited to facilitate cross-functional transformational change within organizations. Furthermore, engaging employees in sustainability initiatives will help them view their roles as meaningful (Casey & Sieber, 2016), thereby increasing their motivation to support the organization’s sustainability transition.

P5 : Firms with more workforce engagement are associated with higher SDG implementation in the energy sector.

Although these enablers have not yet been tested in the energy sector, few published works point to some of these enablers also being important in the sector. For instance, Kumar (2014) examined sustainability reporting in the energy sector in India, finding that larger firms disclose more detailed sustainability information. In Bangladesh, Raquiba and Ishak (2020) focused on the energy sector, revealing that sustainability-related reporting practices in the sector are generally low but positively influenced by enablers such as ownership structure. The authors also point out a positive association between board size and sustainability reporting, which is consistent with some studies performed in other sectors and regions (Rosati & Faria, 2019b).

The imperative to test the enablers that can facilitate SDG implementation arises from a notable gap in the existing scholarly landscape focused on the energy sector, as no prior studies have comprehensively addressed them.

3. Methodology

3.1. Sample and data collection

The dataset used to achieve the objective of the present paper was sourced from the 2022 Refinitiv Eikon database. Refinitiv is a secondary source of data that provides wide and comprehensive details for financial and non-financial variables (Almaqtari et al., 2023). This large database has served as the foundation for numerous recent studies in the field of sustainability research. For example, Bifulco et al. (2023) used panel data to examine the relationship between ESG score sand market values through the moderating role of the firm's CSR committee, while Lee et al. (2023) analyses the relationship among independent third-party rating agency weighted ESG scores, balanced weighted ESG scores, and firm performance.

In this study, the sample is restricted to worldwide publicly listed firms belonging to the economic Energy sector according to The Refinitiv Business Classification (TRBC). Of the total of 2,368 listed firms from the energy sector included in the Refinitiv database, the sample was limited to (i) firms that reported information relating to the number of implemented SDGs and (ii) firms belonging to fossil fuels or to renewable business sectors. The firms from the uranium business sector were not included in the sample due to the low number of firms with available information (n=15) on the number of implemented SDGs.

In total, the sample was composed of 522 firms, 454 (87%) from the fossil fuels energy sector and 68 (13%) from the renewable energy business sector. Table 1 presents the main descriptive statistics of the sample, which consists of large firms with a high number of employees and assets.

Table 1. Descriptive statistics of the sample

| Employees (n) | Assets ($) | Revenue ($) | Market capitalization ($) | |

| n | 377 | 522 | 522 | 522 |

| Min | 0* | 8.08M | 11,721.98 | 215 |

| Mean | 14,190.65 | 17,488.78M | 16,189.65M | 13,663.68M |

| Max | 468,000 | 576,133.52M | 603,240.08M | 1,931,006.93M |

| St. Dev. | 49,065.71 | 52,871.11M | 52,642.11M | 89,520.41M |

* two fossil fuel firms are Limited Partnerships (LPs) with no employees

Their revenues and market capitalisation range between 11,721.98M$-603,240M$ and 215$-1,931,006M$, respectively. They are mainly large international firms with a presence in multiple countries and, therefore, a high economic and environmental impact at a worldwide level.

3.2. Measures

Following the terminology of Palau-Pinyana et al. (2023) and based on the results of the prior literature review, a selection of proxy variables from the Refinitiv Eikon database were chosen for the current investigation. The number of implemented SDGs was a continuous variable ranging from 0 to 17. To measure the size of the firms, revenue was selected, since it is often used as they reflect the total income a firm generates from its activity (Dang et al., 2018) and computed as the natural logarithm of revenue. Innovation was measured as the Environmental Innovation Scores (EIS) provided by Refiniv Eikon database. EIS is ranged from 0 to 12, since the database classifies the firms in four categories, from A to D, and each category is divided into three subcategories (-, blank and +). Executive members’ gender diversity was expressed as a fraction of 100, meaning the percentage of female executive members in the firm. External assurance was measured with Quality Management System (QMS). It was computed as a dummy variable that differentiated whether the firm applies QMS, such as ISO9000 and TQM. Finally, workforce engagement was another dummy variable that discerned whether the firm encourages employee engagement in voluntary work during working hours or volunteerism associated with a firm's project or an NGO project.

Last, to control the differences in the number of implemented SDG in the firm due to country-level factors, the 2022 Environmental Performance Index (EPI, 2022) of the country where the headquarters of the firm is located was also included. EPI provides a data-driven overview of the global sustainability situation, rating 180 countries according to their performance on climate change, environmental health and ecosystem vitality (EPI, 2023). Descriptive statistics and an extended description of all the proxy variables chosen, including the EPI control variable, are included in the Appendix.

3.3. Methods

For the purpose of the first research question, the dataset was analysed using a bootstrap procedure. Bootstrap is a very popular method for estimating variances and constructing confidence intervals (Imbens & Menzel, 2018). It was introduced by Efron (1982) and consists in randomly resampling a set of data multiple times (Henderson, 2005). Unlike multiple regression analysis, bootstrap does not assume normality of the sampling distribution (Hesterberg, 2011), which fits with the nature of the sample of this study due to the high number of firms having implemented no SDGs, as can be observed in the next results section. The non-normality of the data was confirmed based on both univariate and multivariate tests, with significant skewness for SDG (Z_skew = 5.916), Revenue (Z_skew = -6.615), and EIS (Z_skew = 10.962), as well as kurtosis deviations in Revenue (Z_kurt = 10.626) and QMS (Z_kurt = -9.281).

Further, a two-tailed test of bootstrapping routine at 5% significance level and with 5,000 bootstrapping subsamples was run to check the significance of the path coefficients between the enablers and the number of implemented SDGs, based on percentile confidence intervals. The SmartPLS 4 software package (Ringle et al., 2022) was employed for data analysis.

Complementary to Bootstrapping, QCA was employed to answer the second research question. QCA is an emerging method in social sciences that assumes a nuanced perspective on causality by relying on Boolean logic rather than traditional correlation methods for establishing causal conditions linked to a specific outcome (Ragin, 2008). Among the different existing approaches, the fuzzy-set QCA (fsQCA) approach was applied, the main reason for which was that it offers a more realistic approach since the variables can have any value within the 0–1 range (Pappas & Woodside, 2021) and are not only binary variables.

The principles developed by fsQCA are causal asymmetry and equifinality. Causal asymmetry is based on the fact that a condition (or combination of conditions) that explains the presence of an outcome may be different from the conditions that lead to the occurrence of it (Fiss, 2011), whereas equifinality indicates the premise that multiple combinations of antecedent conditions are equally effective (Woodside, 2014).

Applying fsQCA can identify the combination of enablers that better explain a high SDG implementation, and more importantly, it examines the relationship between antecedents and the role of each antecedent of the combination in achieving high SDG implementation, from which systemic theory is established. The software used was fsQCA 3.0 (Ragin & Davey, 2016).

4. Results

Most of the firms in the sample (n=263, 50.38%) had not implemented any SDGs. Therefore, the sample did not follow a normal distribution, as mentioned previously. Of the remaining firms, 46 had implemented all 17 SDGs, while the average number of SDGs implemented per firm was less than six. Figure 1 presents the number of firms by number of implemented SDGs when they have at least one implemented SDG for the energy sector.

Figure 1. Number of firms with at least one SDG implemented, by number of SDGs implemented (n=259)

Source: own elaboration

Figure 2 presents the distribution of the firms that had implemented at least one SDG by business sector. Proportionally, the firms from the renewable energy business sector seem to have a slightly higher number of implemented SDGs, but apparently not significantly so. Similarly, when the focus is on the firms that had implemented no SDGs, there are no significant differences by business sector. Of the 263 that had implemented no SDGs, 231 (50.38%) belonged to the fossil fuels energy sector and 32 (47.06%) to the renewable energy business sector.

Figure 2. Number of firms by number of SDGs implemented by business sector (n=259)

Source: own elaboration

When the rest of enablers and the control variable EPI are also analysed by business sector, higher differences arise in some cases. The differences in terms of EIS, the implementation of QMS and workforce engagement are significant, while the EIS and the percentage of firms with QMS implemented in the renewable energy sector are higher, and workforce engagement is higher in fossil fuel firms (see Table 2).

Table 2. Descriptive statistics of the enablers by business sector.

| Fossil fuels (n=454) | Renewable energy (n=68) | ||||

| Mean | % | Mean | % | ||

| Revenue | 21.50 | 19.87 | |||

| EIS | 1.72 | 4.76 | |||

| Gender diversity | 13.23 | 12.61 | |||

| QMS | No | 57% (n=262) | 29% (n=20) | ||

| Yes | 43% (n=192) | 70% (n=48) | |||

| Workforce engagement | No | 31% (n=143) | 55% (n=38) | ||

| Yes | 69% (n=311) | 45% (n=30) | |||

| EPI | 48.71 | 49.15 | |||

Correlation analysis and collinearity diagnostics of the enablers were performed before proceeding with the bootstrapping analysis. As none of the enablers had a variance inflation factor (VIF) value greater than 3 (Manley et al., 2021), the absence of collinearity was assured.

4.1. Bootstrapping

The bootstrapping results are presented in Table 3. Three models were calculated to test the direct relationships between the enablers, in conjunction with the control variable EPI and the number of implemented SDGs. After performing bootstrapping, unobserved heterogeneity was analysed using the FIMIX-PLS method, with solutions ranging from one to six segments, confirming the validity and robustness of the results obtained.

The first model includes all firms from the energy sector, while the second model focuses on firms from the fossil fuels sector, and the third is limited to renewable energy firms. All three models exhibit acceptable goodness-of-fit values, with R² values ranging from 18% to 24%.

Table 3. Bootstrapping results

| Model 1 | Model 2 | Model 3 | ||||

| Energy sector

(n= 522) |

Fossil fuels

(n=454) |

Renewable energy

(n= 68) | ||||

| β | t-statistic | β | t-statistic | β | t-statistic | |

| Revenue | .20 | 4.81*** | .21 | 4.36*** | -.01 | .08 |

| EIS | .19 | 4.17*** | .18 | 3.67** | .16 | 1.15 |

| Gender | .10 | 2.53* | .1 | 2.31* | .07 | .56 |

| QMS | .42 | 4.96*** | .47 | 5.27*** | .18 | .54 |

| Engagement | .30 | 3.40*** | .26 | 2.8*** | .48 | 1.82 |

| EPI | .04 | .90 | .09 | 2.01* | -.29 | 2.22* |

| R2 | .25 | .25 | .25 | |||

| Adjusted R2 | .24 | .24 | .18 | |||

*** significant at .001 level; **significant at 0.01 level; *significant at 0.05 level

The results for Models 1 and 2 are quite similar, with the exception of the control variable EPI, which is only significant in Model 2. In both models, the enablers with the greatest impact on the number of SDGs implemented by the firm are QMS and workforce engagement, indicating that well-structured quality management processes and employee involvement are key drivers for achieving sustainability goals in the energy sector, especially within fossil fuel firms. This similarity in results can largely be attributed to the size of the fossil fuels subsample, which comprises more than 85% of the total sample. As a result, the findings from Model 1 are likely dominated by trends in the fossil fuels sector, diluting potential differences that could arise from other subsectors within the energy industry.

Furthermore, the significance of EPI (Environmental Performance Index) in Model 2 suggests that fossil fuel firms may be more sensitive to external environmental performance metrics, possibly due to regulatory pressures or public scrutiny. This contrasts with Model 1, where EPI does not play a significant role, potentially because the broader energy sector includes firms with varying levels of exposure to environmental regulations and performance standards.

In contrast, the results for Model 3, which focuses on the renewable energy sector, differ substantially. None of the enablers in this model are significant, except for EPI, which is significant but with a negative coefficient. This negative relationship suggests that higher environmental performance, as measured by EPI, might be associated with fewer SDGs implemented in renewable energy firms. One possible explanation is that renewable energy firms may already have inherently higher environmental performance and therefore do not feel the need to adopt as many additional sustainability practices, as they may consider their core activities sufficiently aligned with sustainability goals. Additionally, the smaller sample size (n = 68) could limit the statistical power of the model, making it more difficult to detect significant relationships among the enablers.

Overall, these results highlight the critical role that quality management systems and workforce engagement play in driving sustainability in the energy sector, particularly in fossil fuel firms, while also underscoring the distinct dynamics at play within the renewable energy sector, where external environmental performance metrics might play a more complex role in shaping sustainability efforts.

4.2. Qualitative comparative analysis

There were three steps in the fsQCA procedure. First, the calibration of outcome (number of SDGs implemented) and antecedent conditions (enablers) into fuzzy sets was performed (Ragin, 2008). Following the recommendations of Greckhamer (2016), Misangyi et al. (2017), and Pappas and Woodside (2021), in dealing with the absence of theoretical guidance (exploratory nature), researchers are typically guided by the distribution characteristics of the data. More specifically, the percentiles of .95, .50 and .05 were computed to establish the thresholds, following the recommendation of Pappas and Woodside (2021). Based on the assumption of a normal distribution, with mediation as the crossover point due to its reduced susceptibility to potential outliers when compared to the mean. The antecedents revenue, gender, EPI, and the outcome SDGs implemented are calibrated following the logic (as shown in Table 4). However, given the non-normal distribution of the other three antecedents EIS, QMS and Engagement, we further combined the mean value as the crossover points.

Table 4. Calibration

| Condition | Fossil fuels | Renewable energy | |||||

| Fully in | Crossover point | Fully out | Fully in | Crossover point | Fully out | ||

| Antecedents | Revenue | 24.38 | 21.42 | 18.80 | 22.621 | 20.445 | 16.031 |

| EIS | 9 | 4.5 | 0 | 6 | 3 | 0 | |

| Gender | 33.33 | 11.11 | 0 | 27.27 | 10.555 | 0 | |

| QMS | 1 | .5 | 0 | 1 | .5 | 0 | |

| Engagement | 1 | .5 | 0 | 1 | .5 | 0 | |

| EPI | 60.1 | 51.1 | 28.4 | 72.7 | 51.1 | 28.4 | |

| Outcome | SDG | 16 | 8 | 0 | 15.3 | 3.5 | 0 |

Second, it was required that we test whether a condition was necessary to produce the outcome. According to Schneider et al. (2010), an isolated condition is necessary when its consistency score exceeds the cut-off level of .9. Table 5 presents the consistency values of all conditions. Since the highest consistency value of a condition was .828 (workforce engagement), there was no antecedent condition that alone could predict a higher number of implemented SDGs, thereby reinforcing the expectation of complex causality.

Table 5. Analysis of necessary conditions

| Conditions | Consistency | Coverage |

| BusinessSector | .252958 | .541122 |

| ~BusinessSector | .881874 | .378859 |

| Revenue | .755288 | .529607 |

| ~Revenue | .46854 | .342238 |

| EIS | .481446 | .658391 |

| ~EIS | .706935 | .342518 |

| Gender | .615583 | .489297 |

| ~ Gender | .578849 | .376590 |

| QMS | .691728 | .533583 |

| ~QMS | .443106 | .295643 |

| Engagement | .828488 | .464626 |

| ~ Engagement | .306344 | .302697 |

| EPI | .589827 | .436775 |

| ~EPI | .651941 | .451245 |

Third, the truth table was constructed, representing data patterns. The fuzzy truth table is able to assess the distribution of the cases across different logically possible combinations of causal conditions (measure of coverage). The rows in the truth table were reduced to obtain a combination set of causal conditions that are sufficient to produce the outcome. A version of the Quine-McCluskey algorithm (Quine, 1952) was applied since it is the most common choice (Berbegal-Mirabent & Llopis-Albert, 2016). The threshold of frequency was set at 6 due to the huge size of the whole sample.

The convention of using a configuration chart to report a combination of parsimonious and intermediate solutions was followed (Ragin & Fiss, 2008). In Table 6, black circles (●) indicate the presence of a causal condition, while empty circles (o) indicate its absence, and ambiguous (unclear) conditions are represented by blank cells. Moreover, a small circle indicates that a condition is peripheral to a given configuration, while a large circle points to a core role. A condition is classified as peripheral when it plays a supporting role in the outcome of interest, and as core when it has a strong causal relationship with it (Llach et al. 2023). Table 5 also includes diverse indices to confirm the goodness of fit of the whole model and each of the configurations. For the whole model, solution coverage and solution consistency values are over the recommended minimum values of .25 and .75, respectively (Pappas & Woodside, 2021), while for each of the configurations raw coverage indices range from .10 to .35 and all consistency indices are over .8 (Berbegal-Mirabent & Llopis-Albert, 2016).

Table 6. Sufficient configurations for the energy sector

| Outcome: SDG | ||||

| Energy sector (n=522) | ||||

| #Configuration | 1 | 2 | 3 | 4 |

| BusinessSector* | o | o | o | ● |

| Revenue | ● | ● | ● | |

| EIS | o | ● | ● | |

| Gender | ● | ● | o | |

| QMS | ● | ● | ● | ● |

| Engagement | ● | ● | ● | ● |

| EPI | ● | ● | o | |

| Consistency | .815 | .867 | .893 | .979 |

| Raw coverage | .325 | .216 | .224 | .153 |

| Unique coverage | .076 | .020 | .024 | .035 |

| Solution coverage | .405 | |||

| Solution consistency | .803 | |||

| Frequency cutoff | 6 | |||

*0=Fossil Fuel; 1=Renewable energy

Four configurations created sufficient conditions to explain the combinations that better explain high SDG implementation: configurations 1, 2 and 3 for the fossil fuels sector and configuration 4 for the renewable energy sector. In all the combinations at least one of the enablers is present as a core condition. However, in none of the four combinations are all the enablers present at the same time. The overall solution consistency was .803, which explains the significance level of all the configurations. In addition, the results show that the four configurations captured 40% of the high SDG implementation.

The implementation of QMS in the firm deserves the most prominent recognition as an enabler since it is present in the four configurations and as a core condition in three of them. Similarly, workforce engagement is present in all the configurations but only as a core condition in two of them. Next, EIS and EPI are present as core conditions in two configurations but absent with a peripheral role in one configuration. Next, revenue is present in three configurations, but only as a core condition in one of them. Last, gender does not seem to have a common pattern across the four configurations.

Since the role of the conditions for explaining high SDG implementation seemed to be different by business sector, consistent with NRBV, two additional fsQCA analyses were performed for each subsample. For the fossil fuels sector, the sample size was 454, and the frequency cutoff was the same as for the full sample. For the energy business sector, the sample size was 68. At this point, as commonly accepted in small-n number QCA studies (Greckhamer et al., 2013), a frequency threshold of 1 was applied. In this way, only the configurations that included at least one case were presented and the rest were eliminated since they did not have observations. Table 7 presents 3 configurations for the fossil fuels sector and four configurations for the renewable energy sector.

Table 7. Sufficient configurations for the fossil fuels and renewable energy business sectors

| Outcome: SDG | |||||||

| Fossil fuels (n=454) | Renewable energy (n=68) | ||||||

| #Configuration | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| Revenue | ● | ● | o | o | ● | ||

| EIS | o | ● | ● | o | o | ● | |

| Gender | ● | ● | o | ● | ● | ● | |

| QMS | ● | ● | ● | ● | ● | o | ● |

| Engagement | ● | ● | ● | ● | o | ● | ● |

| EPI | ● | ● | o | o | o | ● | |

| Consistency | .814 | .856 | .883 | .921 | .848 | .821 | .820 |

| Raw coverage | .350 | .228 | .239 | .394 | .189 | .126 | .190 |

| Unique coverage | .088 | .024 | .028 | .259 | .083 | .020 | .062 |

| Solution coverage | .402 | .565 | |||||

| Solution consistency | .787 | .814 | |||||

| Frequency cutoff | 6 | 1 | |||||

The configurations for the fossil fuels sector were similar and consistent with the ones obtained in the previous QCA for the full sample. As mentioned in the bootstrapping analysis, the main reason is the size of the sample because the firms from this business sector account for more than 86% of the full sample. Contrarily, a lower frequency cutoff value for the renewable energy sector sample allowed us to present more combinations that better explain a high SDG implementation. However, the four configurations are aligned with the interpretation of the single configuration for this particular business sector and are included in Table 6.

In the three configurations of the fossil fuels sector, most of the enablers are present except for EIS in configuration 2. In the three configurations, QMS is clearly the most prominent enabler jointly with workforce engagement. The role of the rest of the enablers differs according to the configuration. However, in the most relevant combination, configuration 1, only QMS, revenue and gender diversity are present as core conditions for the reason that the combination has the highest raw coverage value (Olaya-Escobar et al., 2020). Specifically, configuration 1 includes the large fossil fuel firms that have a gender-diversified board and have implemented QMS as main enablers that better explain higher SDG implementation.

Different from configuration 1, configuration 2 represents fossil fuel firms of any size located in countries with high EPI which combine the implementation of QMS and the engagement of the workers as a solution for obtaining a high SDG implementation. In this context, the high EPI of the country indicates firms with headquarters in countries with a strong social conscience towards the environment (Dyck et al., 2019).

In addition, unlike the rest of the configurations, the firms of configuration 2 are those with a low capacity to reduce the environmental costs and burdens for their customers. In fact, this is the main difference with the firms included in configuration 3 which combine the same enablers but also have a high capacity to reduce environmental costs and burdens for their customers, thereby creating new market opportunities through new environmental technologies and processes or eco-designed products.

Configurations 4 to 7 illustrate the combinations of enablers for firms from the renewable energy sector. Notable is the absence of enablers in most of them. In fact, only workforce engagement in configuration 4 and revenues in configuration 7 are present as core conditions.

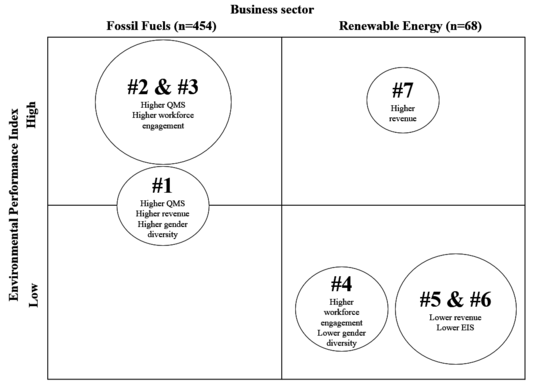

For a better understanding of the theoretical configurations presented in Table 7, Figure 3 depicts them in circles according to the core conditions that characterise them by business sector (horizontal axis) and by the country’s EPI (vertical axis). Each circle may include one or various configurations with the same core conditions. In addition, the size of the circle is proportionate to the degree of coverage of each configuration so as to visualise the most frequent combinations in terms of firms included in the configuration.

Figure 3 clearly highlights that firms in the fossil fuel sector are predominantly located in countries with high environmental performance and share similar key enablers, including higher QMS, greater workforce engagement, higher revenues, and increased gender diversity. In contrast, this trend is not observed in the renewable energy sub-sector, where the enablers vary depending on specific configurations. This suggests that the inherent characteristics of renewable energy firms may already facilitate the implementation of SDGs within this sector.

Figure 3. Configurations chart

Note: the information inside the circles is the number of the configuration and their core conditions

Source: Developed by authors based on the results presented in Table 7

5. Discussion of the results

The findings of this study contribute to the theoretical discourse surrounding the RBV and its extension, NRBV, by analysing how firms in the energy sector leverage specific resources and capabilities to enhance sustainability performance. The RBV posits that unique resources and capabilities are critical for achieving competitive advantage and superior performance. In this context, addressing the first research question, the bootstrapping results empirically validate the set of enablers proposed by Palau-Pinyana et al. (2023) in the energy sector and support our initial propositions. Specifically, the propositions state that firms in the energy sector with larger size, that are more innovative, have greater gender diversity, more external assurance, and greater workforce engagement are all associated with higher SDG implementation. Each of these enablers represents resources that positively influence the number of SDGs implemented in the energy sector.

Specifically, in order of importance, the key enablers are the implementation of QMS—accepting our proposition 4—and workforce engagement—accepting our proposition 5 and confirming recent studies such as Rosati and Faria (2019a) and Westerman (2021). They are pivotal resources significantly influencing the implementation of SDGs in the fossil fuels sector. This aligns with the RBV's assertion that valuable, rare, inimitable, and non-substitutable resources can lead to enhanced organizational performance.

The implementation of QMS has advantages such as cost reduction, efficient use of resources and reduced implementation times, which lead to a reduction of unnecessary redundancies and has the potential to create synergy effects (Karapetrovic, 2002; Karapetrovic & Casadesús, 2009). In addition, involving employees in sustainability will lead them to the perception of their jobs as being meaningful (Casey and Sieber, 2016), making them more motivated to contribute to the transition towards the firm’s sustainability.

However, when the analysis is controlled by business sector, as emphasized by the use of the NRBV framework, the impact of the enablers differs substantially. In the fossil fuels sector, all enablers remain significant, while the enablers for renewable energy firms are mostly insignificant. Notably, the use of these enablers in firms does not correlate with their ability to explain a higher implementation of SDGs. For example, although the number of firms implementing a QMS or achieving a high Environmental Innovation Score is much greater in the renewable energy sector, these resources are significant only in explaining a higher number of SDGs in the fossil fuels sector. Therefore, these results provide evidence of the heterogeneous use and impact of resources in explaining environmental performance across different business sectors in the energy industry.

This distinction is particularly relevant from the perspective of the Natural Resource-Based View (NRBV), which emphasizes the importance of environmental resources and capabilities in achieving sustainability. The study's results highlight that while fossil fuel firms must actively cultivate organizational and operational resources to mitigate their environmental impact, renewable energy firms benefit from the inherently sustainable nature of their business models. This distinction underscores the NRBV's argument that firms must adapt their resource strategies based on their environmental context and the specific challenges they face.

To answer the second research question, the analysis was also performed for the whole of the energy sector and for each of the business sectors due to the results obtained in the first research question. Again, paramount differences arise when controlling by business sector. At a first glance, it becomes evident that the three combinations related to the fossil fuels sector encompass firms not located in countries with low EPI, suggesting the potentially positive impact of a country's environmental performance on its firms. Regarding the most relevant combinations, it was found that these groups are composed of firms characterised by having QMS and workforce engagement.

Contrarily, shifting attention to the renewable energy firm sector, it was observed that combinations demonstrating higher SDG implementation are predominantly situated in countries exhibiting lower environmental performance. Moreover, these configurations generally lack substantial efforts to adopt quality and environmental policies compared to their fossil fuels counterparts. Specifically, the most relevant groups are comprised of smaller firms with modest scores in environmental innovation. In contrast, renewable energy firms generating higher revenues in countries with superior environmental performance are few as they are included in the smallest group. These firms would represent the major players in the renewables sector in wealthier nations.

The innate characteristics of each of the business sectors would explain the differences in the use and combination of these resources in the transition towards sustainability. While the fossil fuel firms would need to have implemented organisational, operational and strategic resources to have a higher environmental performance, the sustainability performance of the renewable energy firms would be due to the inherent nature of the business sector – an idea which is consistent with previous literature (Gonenc & Scholtens, 2017; Kolk & Levy, 2001; Langnel & Amegavi, 2020; Song et al., 2022; Zhang, 2018) and the NRBV framework.

The complementary methodologies employed, bootstrapping and QCA, allows for the exploration of multiple pathways to sustainability performance, thereby enriching the theoretical landscape of RBV and NRBV by demonstrating how different combinations of resources can lead to varied sustainability outcomes across sub-sectors of the energy industry.

In summary, the results of the study add to the growing body of research on global sustainability in the energy sector. They validate previously identified factors that can pave the way for significant contributions to sustainable development in the energy sector and underline the need for all firms in the sector to evolve their sustainability strategies, recognising the challenges inherent in the industry.

6. Conclusions

Firms in the energy sector are major contributors to greenhouse gas emissions and climate change, which have both far-reaching consequences for the environment and a significant impact on society (IEA, 2023; Kud et al., 2021). In the current complex context of the energy sector and following the call for action in the literature (Palau-Pinyana et al., 2023), an aspect that remains understudied concerns the enablers that can facilitate SDG implementation in the industry. Understanding the key enablers driving SDG implementation in the energy sector and the combinations that best explain this implementation can provide valuable insights for academics, industry stakeholders and policy makers.

Theoretical implications

From an academic perspective, three theoretical conclusions emerge. First, the effectiveness of key enablers such as QMS and workforce engagement in promoting SDG implementation exhibits significant variance between business sectors, with a pronounced impact in the fossil fuels sector in comparison to the renewable energy sector. This distinction underscores the need for sector-specific sustainability strategies. Second, the environmental performance of a country seems to play a divergent role in influencing SDG implementation strategies across different sectors. While fossil fuel firms in countries with higher EPI scores tend to implement SDGs more effectively, renewable energy firms in lower EPI countries demonstrate higher SDG implementation, suggesting varying external pressures and incentives across sectors. Third, the inherent characteristics of the business sectors dictate their sustainability performance. Fossil fuel firms rely more on organisational, operational and strategic resources to enhance environmental performance, reflecting efforts to mitigate their naturally higher environmental impact, whereas renewable energy firms’ alignment with SDG goals may be facilitated by the inherently sustainable nature of their business model.

Further, methodologically speaking, the combination of bootstrapping and fuzzy-set Qualitative Comparative Analysis (fsQCA) provides a robust methodological framework for analysing the complexities of SDG implementation in the energy sector. This methodological approach enables an understanding of the conditions under which firms can successfully align with the SDGs and the different pathways to sustainability performance.

In terms of theoretical discourse, the findings of this study contribute to the discussion surrounding the Resource-Based View (RBV) and the Natural Resource-Based View (NRBV) by describing how firms in the energy sector leverage specific resources and capabilities to enhance their sustainability performance. Additionally, the study extends the applicability of these frameworks by illustrating the heterogeneous use and impact of resources across different sectors of the energy industry.

Practical implications

For managers operating in the energy sector, the findings provide valuable insights for the strategic deployment of the SDGs. Key findings include the paramount importance of implementing QMS and promoting workforce engagement as universal enablers of SDG implementation. Firms may need to undergo structural changes to fully utilise their potential in implementing SDGs. This suggests that the pursuit of sustainability goals can be a powerful driver of organisational change, encouraging firms to reassess and realign their resources, capabilities and strategies towards a more sustainable future. Firms in the industrial sector ought to be more dedicated to eco-friendly policies and procedures (Chen et al., 2024). Therefore, in line with the RBV, it is highly important to convey the message to managers that competitive advantage is grounded within the firm, in its resources (Perramon et al. 2022).

Additionally, the findings indicate a relationship between a country's environmental performance and firms' strategies in both business sectors, suggesting that managers should consider the external environmental policy landscape when developing their sustainability strategies. Policymakers are therefore advised to promote the adoption of these key enablers to spur firms to meet the UN 2030 goals. The urgency for the energy sector to align with the 2030 Agenda is evident, necessitating a collaborative approach that includes public-private partnerships (PPPs) (Chen et al., 2021). Better sustainability policies at the country level could indirectly foster business alignment with sustainability practices to attain energy transition (Sinha, et al., 2023), suggesting a beneficial synergy between national environmental policies and business sustainability efforts.

Limitations and future research

This study is not exempt of limitations. First, although the analysis was controlled at country-level with the inclusion of EPI, differences between emerging and developed economies (Alhawaj et al., 2023) were not sufficiently explored. The use of more comprehensive and detailed macroeconomic data could shed more light on this issue. Moreover, while the country-level measure considers national data, it overlooks inter-country relationships and geopolitical risks, which are believed to hinder the global progress to energy transition (Chishti et al., 2023). Further exploration into this phenomenon would be beneficial in gaining a comprehensive understanding of how firms in countries facing geopolitical risks implement SDGs. Second, in the sample selection, firms from the uranium sector were removed from the analysis due to their low representation in the database. Extending the sample or conducting a case study analysis of the uranium firms in the database could provide more information on whether these firms have a differentiated behaviour in their transition towards sustainability. Last but importantly, the study considers the implementation of the SDGs by measuring only their number, so the synergy or trade-offs between the different goals (Boar et al., 2022) requires future research to provide an in-depth understanding of SDG implementation.

7. References

Abdul-Rashid, S. H., Sakundarini, N., Raja Ghazilla, R. A., & Ramayah, T. (2017). The Impact of Sustainable Manufacturing Practices on Sustainability Performance. International Journal of Operations & Production Management, 37(2), 182-204. https://doi.org/10.1108/ijopm-04-2015-0223

Adamkaite, J., Streimikiene, D., & Rudzioniene, K. (2023). The impact of social responsibility on corporate financial performance in the energy sector: Evidence from Lithuania. Corporate Social Responsibility and Environmental Management, 30(1), 91–104. https://doi.org/10.1002/csr.2340

Alhawaj, A., Buallay, A., & Abdallah, W. (2023). Sustainability reporting and energy sectorial performance: developed and emerging economies. International Journal of Energy Sector Management, 17(4), 739–760. https://doi.org/10.1108/IJESM-10-2020-0020

Almaqtari, F. A., Elsheikh, T., Al-Hattami, H. M., & Mishra, N. (2023). The impact of board characteristics on environmentally friendly production: A cross country study in Asia and Europe. Journal of Cleaner Production, 392, 136257. https://doi.org/10.1016/j.jclepro.2023.136257

Barney, J. B. (1991). Firm Resources and Sustained Competitive Advantage. Journal of Management, 17(1), 99–120. https://doi.org/10.1177/014920639101700108

B Barney, J. B. (2001). Resource-Based Theories of Competitive Advantage: A Ten-Year Retrospective on the Resource-Based View. Journal of Management. 27(6), 643-650. https://doi.org/10.1177/014920630102700602

Battaglia, M., Annesi, N., Calabrese, M., & Frey, M. (2020). Do agenda 2030 and Sustainable Development Goals act at local and operational levels? Evidence from a case study in a large energy company in Italy. Business Strategy & Development, 3(4), 603-614. https://doi.org/10.1002/bsd2.125

Berbegal-Mirabent, J., & Llopis-Albert, C. (2016). Applications of fuzzy logic for determining the driving forces in collaborative research contracts. Journal of Business Research, 69(4), 1446–1451. https://doi.org/10.1016/j.jbusres.2015.10.123

Bifulco, G. M., Savio, R., Paolone, F., & Tiscini, R. (2023). The CSR committee as moderator for the ESG score and market value. Corporate Social Responsibility and Environmental Management, 30(6), 3231–3241. https://doi.org/10.1002/csr.2549

Biswas, P. K., Mansi, M., & Pandey, R. (2018). Board composition, sustainability committee and corporate social and environmental performance in Australia. Pacific Accounting Review, 30(4), 517–540. https://doi.org/10.1108/PAR-12-2017-0107

Boar, A., Palau Pinyana, E., & Oliveras-Villanueva, M. (2022). Alternatives to solve SDG trade-offs and to enforce SDG synergies: a systematic literature review. Management of Environmental Quality: An International Journal, 33(2), 478–493. https://doi.org/10.1108/MEQ-07-2021-0181

Brammer, S. J., & Pavelin, S. (2006). Corporate Reputation and Social Performance: The Importance of Fit. Journal of Management Studies, 43(3), 435–455. https://doi.org/10.1111/j.1467-6486.2006.00597.x

Bukalska, E., Zinecker, M., & Pietrzak, M. B. (2021). Socioemotional Wealth (SEW) of Family Firms and CEO Behavioral Biases in the Implementation of Sustainable Development Goals (SDGs). Energies, 14(21), 7411. https://doi.org/10.3390/en14217411

Cain, M. K., Zhang, Z., & Yuan, K.-H. (2017). Univariate and multivariate skewness and kurtosis for measuring nonnormality: Prevalence, influence, and estimation. Behavior Research Methods, 49(5), 1716–1735. https://doi.org/10.3758/s13428-016-0814-1

Calabrese, A., Forte, G., & Ghiron, N. L. (2018). Fostering sustainability-oriented service innovation (SOSI) through business model renewal: The SOSI tool. Journal of Cleaner Production, 201, 783–791. https://doi.org/10.1016/j.jclepro.2018.08.102

Casey, D., & Sieber, S. (2016). Employees, sustainability and motivation: Increasing employee engagement by addressing sustainability and corporate social responsibility. Research in Hospitality Management, 6(1), 69-76. https://doi.org/10.2989/RHM.2016.6.1.9.1297

Chan, K. M. A., Boyd, D. R., Gould, R. K., Jetzkowitz, J., Liu, J., Muraca, B., Naidoo, R., Olmsted, P., Satterfield, T., Selomane, O., Singh, G. G., Sumaila, R., Ngo, H. T., Boedhihartono, A. K., Agard, J., Aguiar, A. P. D., Armenteras, D., Balint, L., Barrington‐Leigh, C., … Brondízio, E. S. (2020). Levers and leverage points for pathways to sustainability. People and Nature, 2(3), 693–717. https://doi.org/10.1002/pan3.10124

Chen, D., Hu, H., Wang, N., & Chang, C. P. (2024). The impact of green finance on transformation to green energy: Evidence from industrial enterprises in China. Technological Forecasting and Social Change, 204, 123411. https://doi.org/10.1016/j.techfore.2024.123411

Chen, M., Sinha, A., Hu, K., & Shah, M. I. (2021). Impact of technological innovation on energy efficiency in industry 4.0 era: Moderation of shadow economy in sustainable development. Technological Forecasting and Social Change, 164, 120521. https://doi.org/10.1016/j.techfore.2020.120521

Chishti, M. Z., Sinha, A., Zaman, U., & Shahzad, U. (2023). Exploring the dynamic connectedness among energy transition and its drivers: Understanding the moderating role of global geopolitical risk. Energy Economics, 119, 106570. https://doi.org/10.1016/j.eneco.2023.106570

Cordova, M. F., & Celone, A. (2019). SDGs and innovation in the business context literature review. Sustainability (Switzerland), 11(24). https://doi.org/10.3390/su11247043

Darnall, N., & Edwards, D. (2006). Predicting the cost of environmental management system adoption: the role of capabilities, resources and ownership structure. Strategic Management Journal, 27(4), 301–320. https://doi.org/10.1002/smj.518

Dang, C., (Frank) Li, Z., & Yang, C. (2018). Measuring firm size in empirical corporate finance. Journal of Banking & Finance, 86, 159–176. https://doi.org/10.1016/j.jbankfin.2017.09.006

Efron, B. (1982). The Bootstrap. In The Jackknife, the Bootstrap and Other Resampling Plans (pp. 27–36). Society for Industrial and Applied Mathematics. https://doi.org/10.1137/1.9781611970319.ch5

EPI. (2022). Environmental Performance Index. Yale Center for Environmental Law & Policy and Center for International Earth Science Information Network (CIESIN). Columbia University’s Earth Institute, United States of America.

Fiss, P. C. (2011). Building Better Causal Theories: A Fuzzy Set Approach to Typologies in Organization Research. Academy of Management Journal, 54(2), 393–420. https://doi.org/10.5465/amj.2011.60263120

Fitjar, R. D. (2011). Little big firms? Corporate social responsibility in small businesses that do not compete against big ones. Business Ethics: A European Review, 20(1), 30–44. https://doi.org/10.1111/j.1467-8608.2010.01610.x

Fuso Nerini, F., Tomei, J., To, L. S., Bisaga, I., Parikh, P., Black, M., Borrion, A., Spataru, C., Castán Broto, V., Anandarajah, G., Milligan, B., & Mulugetta, Y. (2017). Mapping synergies and trade-offs between energy and the Sustainable Development Goals. Nature Energy, 3(1), 10–15. https://doi.org/10.1038/s41560-017-0036-5

Gallo, P. J., & Christensen, L. J. (2011). Firm Size Matters: An Empirical Investigation of Organizational Size and Ownership on Sustainability-Related Behaviors. Business & Society, 50(2), 315–349. https://doi.org/10.1177/0007650311398784

Gasparatos, A., Doll, C. N. H., Esteban, M., Ahmed, A., & Olang, T. A. (2017). Renewable energy and biodiversity: Implications for transitioning to a Green Economy. Renewable and Sustainable Energy Reviews, 70, 161–184. https://doi.org/10.1016/j.rser.2016.08.030

Girón, A., Kazemikhasragh, A., Cicchiello, A. F., & Monferrá, S. (2022). The Impact of Board Gender Diversity on Sustainability Reporting and External Assurance: Evidence from Lower-Middle-Income Countries in Asia and Africa. Journal of Economic Issues, 56(1), 209–224. https://doi.org/10.1080/00213624.2022.2020586

Gonenc, H., & Scholtens, B. (2017). Environmental and Financial Performance of Fossil Fuel Firms: A Closer Inspection of their Interaction. Ecological Economics, 132, 307–328. https://doi.org/10.1016/j.ecolecon.2016.10.004

Grant, R. M. (1991). The Resource-Based Theory of Competitive Advantage: Implications for Strategy Formulation. California Management Review, 33(3), 114–135. https://doi.org/10.2307/41166664

Gusmão Caiado, R. G., Leal Filho, W., Quelhas, O. L. G., de Mattos Nascimento, D., & Ávila, L. v. (2018). A literature-based review on potentials and constraints in the implementation of the sustainable development goals. Journal of Cleaner Production, 198, 1276–1288. https://doi.org/10.1016/j.jclepro.2018.07.102

Hart, S. L. (1995). A Natural-Resource-Based View of the Firm. The Academy of Management Review, 20(4), 986. https://doi.org/10.2307/258963

Henderson, A. R. (2005). The bootstrap: A technique for data-driven statistics. Using computer-intensive analyses to explore experimental data. Clinica Chimica Acta, 359(1–2), 1–26. https://doi.org/10.1016/j.cccn.2005.04.002

Hesterberg, T. (2011). Bootstrap. WIREs Computational Statistics, 3(6), 497–526. https://doi.org/10.1002/wics.182

Hörisch, J., Johnson, M. P., & Schaltegger, S. (2015). Implementation of Sustainability Management and Company Size: A Knowledge-Based View. Business Strategy and the Environment, 24(8), 765–779. https://doi.org/10.1002/bse.1844

Hu, M. K., & Hung Kee, D. M. (2021). Fostering Sustainability: Reinventing SME Strategy in the New Normal. Foresight. 24(3/4), 301-318. https://doi.org/10.1108/fs-03-2021-0080

IEA. (2022). World Energy Investment, International Energy Agency. https://www.iea.org/reports/world-energy-investment-2023.

Imaz, O., & Eizagirre, A. (2020). Responsible Innovation for Sustainable Development Goals in Business: An Agenda for Cooperative Firms. Sustainability, 12(17), 6948. https://doi.org/10.3390/su12176948

Imbens, G., & Menzel, K. (2018). A Causal Bootstrap. https://doi.org/10.3386/w24833

Karapetrovic, S. (2002). Strategies for the integration of management systems and standards. The TQM magazine, 14(1), 61-67. https://doi.org/10.1108/09544780210414254

Karapetrovic, S., & Casadesús, M. (2009). Implementing environmental with other standardized management systems: Scope, sequence, time and integration. Journal of Cleaner Production, 17(5), 533-540. https://doi.org/10.1016/j.jclepro.2008.09.006

Kolk, A. (2016). The social responsibility of international business: From ethics and the environment to CSR and sustainable development. Journal of World Business, 51(1), 23–34. https://doi.org/10.1016/j.jwb.2015.08.010

Kolk, A., & Levy, D. (2001). Winds of Change: Corporate Strategy, Climate change and Oil Multinationals. European Management Journal, 19(5), 501–509. https://doi.org/10.1016/S0263-2373(01)00064-0

Kud, K., Woźniak, M., & Badora, A. (2021). Impact of the Energy Sector on the Quality of the Environment in the Opinion of Energy Consumers from Southeastern Poland. Energies, 14(17), 5551. https://doi.org/10.3390/en14175551

Kumar, D., (2014). Sustainability Reporting Practices by Energy Sector in India. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2376176

Langnel, Z., & Amegavi, G. B. (2020). Globalization, electricity consumption and ecological footprint: An autoregressive distributive lag (ARDL) approach. Sustainable Cities and Society, 63, 102482. https://doi.org/10.1016/j.scs.2020.102482

Lee, M. T., Raschke, R. L., & Krishen, A. S. (2023). Understanding ESG scores and firm performance: are high-performing firms E, S, and G-balanced?. Technological Forecasting and Social Change, 195, 122779. https://doi.org/10.1016/j.techfore.2023.122779

Llach, J., Sanchez-Famoso, V., & Danes, S. M. (2023). Unmasking nonfamily employees’ complex contribution to family business performance: A place identity theory approach. Journal of Family Business Strategy, 14(4), 100593. https://doi.org/10.1016/j.jfbs.2023.100593

Makridou, G., Doumpos, M., & Lemonakis, C. (2023). Relationship between ESG and corporate financial performance in the energy sector: empirical evidence from European companies. International Journal of Energy Sector Management. https://doi.org/10.1108/IJESM-01-2023-0012

Mardia, K. V. (1970). Measures of multivariate skewness and kurtosis with applications. Biometrika, 57(3), 519–530. https://doi.org/10.1093/biomet/57.3.519

Mattera, M., & Soto, F. (2023). Dodging the bullet: overcoming the financial impact of Ukraine armed conflict with sustainable business strategies and environmental approaches. The Journal of Risk Finance, 24(1), 122–142. https://doi.org/10.1108/JRF-04-2022-0092

McDougall, N., Wagner, B., & MacBryde, J. (2019). An empirical explanation of the natural-resource-based view of the firm. Production Planning & Control, 30(16), 1366–1382. https://doi.org/10.1080/09537287.2019.1620361

Montiel, I., Cuervo-Cazurra, A., Park, J., Antolín-López, R., & Husted, B. W. (2021). Implementing the United Nations’ Sustainable Development Goals in international business. Journal of International Business Studies, 52(5), 999–1030. https://doi.org/10.1057/s41267-021-00445-y

Muhammad, H., & Migliori, S. (2022). Effects of board gender diversity and sustainability committees on environmental performance: a quantile regression approach. Journal of Management & Organization, 1–26. https://doi.org/10.1017/jmo.2022.8

Olfe-Kräutlein, B. (2020). Advancing CCU Technologies Pursuant to the SDGs: A Challenge for Policy Making. Frontiers in Energy Research, 8. https://doi.org/10.3389/fenrg.2020.00198

Palau-Pinyana, E., Llach, J., & Bagur-Femenías, L. (2023). Mapping enablers for SDG implementation in the private sector: a systematic literature review and research agenda. Management Review Quarterly. https://doi.org/10.1007/s11301-023-00341-9

Pappas, I. O., & Woodside, A. G. (2021). Fuzzy-set qualitative comparative analysis (fsQCA): Guidelines for research practice in information systems and marketing. International Journal of Information Management, 58(1), Article 102310. https://doi.org/10.1016/j.ijinfomgt.2021.102310

Paramati, S. R., Sinha, A., & Dogan, E. (2017). The significance of renewable energy use for economic output and environmental protection: evidence from the Next 11 developing economies. Environmental Science and Pollution Research, 24(15), 13546–13560. https://doi.org/10.1007/s11356-017-8985-6

Pawliczek, A., & Piszczur, R. (2013). Effect of management systems ISO 9000 and ISO 14000 on enterprises’ awareness of sustainability priorities. E & M Ekonomie a Management, 16, 66–80.

Penrose, E. (1995). The Theory of the Growth of the Firm. Oxford University Press, Oxford. https://doi.org/10.1093/0198289774.001.0001

Perramon, J., Oliveras-Villanueva, M., & Llach, J. (2022). Impact of service quality and environmental practices on hotel companies: An empirical approach. International Journal of Hospitality Management, 107, 103307. https://doi.org/10.1016/j.ijhm.2022.103307

Peteraf, M. A. (1993). The cornerstones of competitive advantage: A resource‐based view. Strategic Management Journal, 14(3), 179–191. https://doi.org/10.1002/smj.4250140303

Quine, W. V. (1952). The problem of simplifying truth functions. American Mathematical Monthly, 59(8), 521–531. https://doi.org/10.1080/00029890.1952.11988183

Ragin, C. C. (2008). Redesigning Social Inquiry Fuzzy Sets and Beyond. University of Chicago Press.

Ragin, C. C., & Rihoux, B. (2009). Configurational Comparative Methods: Qualitative Comparative Analysis (QCA) and Related Techniques (Vol. 51). Thousand Oaks, CA: Sage Publications, Inc. https://doi.org/10.4135/9781452226569

Ragin, C. C., & Davey, S. (2016). Fuzzy-Set/Qualitative comparative analysis 3.0. University of California Press.

Ragin, C.C., & Fiss, P.C. (2008). Net effects analysis versus configurational analysis: an empirical demonstration. In: Ragin, C.C. (ed.) Redesigning Social Inquiry: Fuzzy Sets and Beyond, pp. 190–212. University of Chicago Press, Chicago.

Ragin, C. C., & Rihoux, B. (2009). Configurational comparative methods. Qualitative Comparative Analysis (QCA) and Related Techniques (Vol. 51). SAGE.

Raquiba, H., & Ishak, Z. (2020). Sustainability reporting practices in the energy sector of Bangladesh. International Journal of Energy Economics and Policy, 10(1), 508–516. https://doi.org/10.32479/ijeep.8621

Rashed, A. H., & Shah, A. (2021). The role of private sector in the implementation of sustainable development goals. Environment, Development and Sustainability, 23(3), 2931–2948. https://doi.org/10.1007/s10668-020-00718-w

Reuters Group. (2020). The Refinitiv Business Classification (TRBC).

Ringle, C. M., Wende, S., & Becker, J. (2022). SmartPLS 4. Oststeinbek: SmartPLS.

Rosati, F., & Faria, L. G. D. (2019a). Addressing the SDGs in sustainability reports: The relationship with institutional factors. Journal of Cleaner Production, 215, 1312–1326. https://doi.org/10.1016/j.jclepro.2018.12.107

Rosati, F., & Faria, L. G. D. (2019b). Business contribution to the Sustainable Development Agenda: Organizational factors related to early adoption of SDG reporting. Corporate Social Responsibility and Environmental Management, 26(3), 588–597. https://doi.org/10.1002/csr.1705

Roxas, B., Ashill, N. J., & Chadee, D. (2017). Effects of Entrepreneurial and Environmental Sustainability Orientations on Firm Performance: A Study of Small Businesses in the Philippines. Journal of Small Business Management, 55(S1), 163-178. https://doi.org/10.1111/jsbm.12259

Roy, N. K., & Das, A. (2018). Prospects of Renewable Energy Sources. Springer, Singapore, pp. 1–39. https://doi.org/10.1007/978-981-10-7287-1_1

Schneider, M. R., Schulze-Bentrop, C., & Paunescu, M. (2010). Mapping the institutional capital of high-tech firms: A fuzzy-set analysis of capitalist variety and export performance. Journal of International Business Studies, 41, 246-266. https://doi.org/10.1057/jibs.2009.36

Sinha, A., Bekiros, S., Hussain, N., Nguyen, D. K., & Khan, S. A. (2023). How social imbalance and governance quality shape policy directives for energy transition in the OECD countries? Energy Economics, 120, 106642. https://doi.org/10.1016/j.eneco.2023.106642

Song, L., Zhan, X., Zhang, H., Xu, M., Liu, J., & Zheng, C. (2022). How much is global business sectors contributing to sustainable development goals? Sustainable Horizons, 1, 100012. https://doi.org/10.1016/j.horiz.2022.100012

Taminiau, J., Nyangon, J., Lewis, A., & Byrne, J. (2017). Sustainable Business Model Innovation: Using Polycentric and Creative Climate Change Governance. In Collective Creativity for Responsible and Sustainable Business Practice (pp. 140–159). https://doi.org/10.4018/978-1-5225-1823-5.ch008

UN. (2015). Transforming our World: The 2030 Agenda for Sustainable Development - Resolution Adopted by the General Assembly on 25 September 2015.

Valbuena-Hernandez, J. P., & Ortiz-de-Mandojana, N. (2021). Encouraging Corporate Sustainability Through Effective Strategic Partnerships. Corporate Social Responsibility and Environmental Management. https://doi.org/10.1002/csr.2188

Velte, P. (2022). Does sustainable board governance drive corporate social responsibility? A structured literature review on European archival research. Journal of Global Responsibility. https://doi.org/10.1108/JGR-05-2022-0044

Wang, X., Lin, H., & Weber, O. (2016). Does Adoption of Management Standards Deliver Efficiency Gain in Firms’ Pursuit of Sustainability Performance? An Empirical Investigation of Chinese Manufacturing Firms. Sustainability, 8(7), 694. https://doi.org/10.3390/su8070694

Wernerfelt, B. (1984). A resource‐based view of the firm. Strategic Management Journal, 5(2), 171–180. https://doi.org/10.1002/smj.4250050207

Westerman, J. W. (2021). A sustainable plan to rescue HR from itself. Sustainability (Switzerland), 13(14). https://doi.org/10.3390/su13147587

Woodside, A. G. (2014). Embrace perform model: Complexity theory, contrarian case analysis, and multiple realities. Journal of Business Research, 67(12), 2495–2503. https://doi.org/10.1016/j.jbusres.2014.07.006

Yin, T., Fu, J., Zeng, Y., Cao, K., Bai, C., Wang, D., Li, S., Xue, Y., Ma, L., & Zheng, C. (2015). Ligand-Exchange Mechanism: New Insight Into Solid-Phase Extraction of Uranium Based on a Combined Experimental and Theoretical Study. Physical Chemistry Chemical Physics. https://doi.org/10.1039/c4cp05508j