Quantifying the Potential Economic Impact of Catalan Independence: A General Equilibrium Analysis of Different Scenarios

In December 2019, during one of the most followed sporting events (the classic football match “El Clásico” between FC Barcelona and Real Madrid), a huge banner was unfurled at Camp Nou with a strong message: #SpainSitAndTalk. It urged the Spanish government to sit around the negotiating table and discuss the possible secession of Catalonia from Spain. Five years later, governments from both sides have initiated dialogue, which includes discussions on a new fiscal framework for Catalonia.

A potential independence of Catalonia from Spain would create a new administrative border between Catalonia and the rest of Spain, which would have implications for trade. Traded goods between Catalonia and Spain would cross international borders. Furthermore, there is uncertainty on whether Catalonia would become a European Union (EU) member state and would thus face higher trade costs with EU countries. Within an international trade framework, Adam, Larch, and Paniagua (2023) quantify the economic impact of a potential secession of Catalonia from Spain, modelling the associated political uncertainty, for example regarding EU or World Trade Organisation (WTO) membership, thereby extending the few existing studies (e.g. Comerford et al., 2014, 2019).

First, our study investigates the border effect of international trade, that is, the observed difference in international trade compared to domestic trade within a country. The border effect has been extensively studied in the literature, e.g. McCallum (1995) and Anderson and van Wincoop (2003). Most existing studies define borders as international borders, i.e. between different countries. Our study, however, defines different types of borders, not only between countries, but also between regions within countries, and hence differentiates between country-to-country, region-to-country, and region-to-region borders, see also Coughlin and Novy (2021) or Santamaría, Ventura, and Yeşilbayraktar (2023). The differentiation is essential when considering Catalan independence, as the Catalan border with the other Spanish regions would turn into an international border. Typically, there is more trade within than across countries, suggesting that international borders are “thicker” than regional borders. Our study’s first contribution is estimating different types of border effects, which cannot be accomplished using standard international trade data. Therefore, we construct a novel dataset including trade flows between all 17 Spanish Autonomous Communities and 142 countries worldwide from 2001 to 2017. The Spanish regional and region-to-country trade flows come from the C-Intereg project and the country-to-country trade flows are taken from the ITPD-E Release 2 dataset. The data structure allows us to dissect trade borders into different types (regional, national, EU).

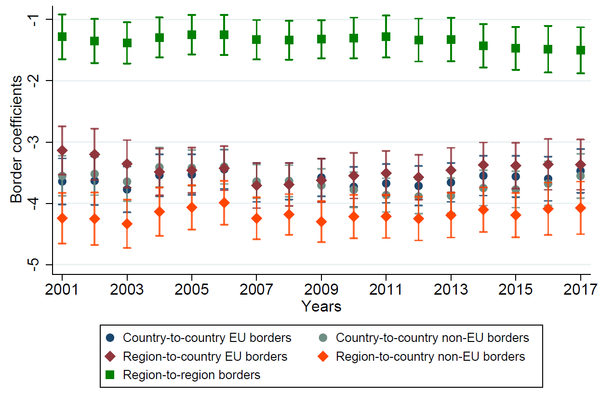

Estimating the different border effects using state-of-the-art gravity estimation methods reveals substantial heterogeneity in trade borders. Figure 1 displays the different types of border effects estimated over the years 2001-2017. It reveals a significant difference between the regional and international borders, supporting our expectation that international borders are thicker (border coefficients between -3 and -4.5) than regional borders (border coefficients between -1 and -2). Within a type of border, there are no significant differences in the estimated coefficients over time. Hence, while we see substantial differences across different types of borders, these differences remain relatively stable over time. To quantify the costs of a potential Catalan secession we, therefore, use a framework that focuses on the different types rather than changes over time. Specifically, in our second contribution described below, we rely on cross-sectional border effect estimates for analysing the general equilibrium effects of Catalan independence.

Figure 1: EU vs. non-EU Country and Region Borders (Years 2001-2012). Coefficient estimates and 95% confidence intervals over time.

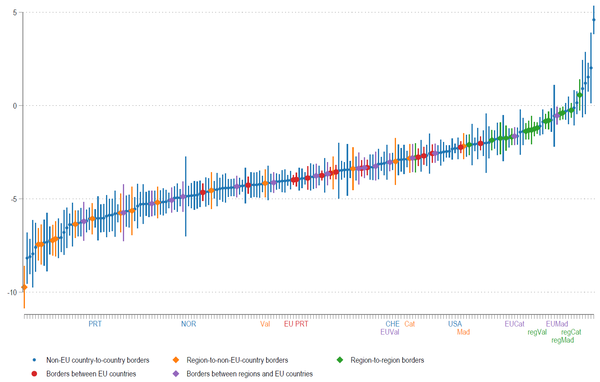

The data also allows us to estimate region- and country-specific border effects, as displayed in Figure 2. It shows that the borders between all Spanish regions are “thinner” than most international borders, as expected. Catalonia seems well-integrated with the other Spanish regions in terms of trade, its regional border being the thinnest among all Spanish regions and only Madrid has thinner EU and non-EU borders. Further results over time suggest that Catalonia has intensified its trade integration with the rest of the world to the detriment of trade with the other Spanish regions in the past years. In the context of potential independence, this suggests that the anticipated rise in trade costs over time may not be as drastic, given that Catalonia already trades less with other Spanish regions and is more integrated in international markets.

Figure 2: Country- and Region-Specific Border Coefficients. Different border levels (regional, EU, non-EU).

Our study’s second contribution is to quantify the potential economic impact of a hypothetical Catalan independence using a general equilibrium analysis. Specifically, we use the structural gravity model of inter- and intra-national trade to investigate how Catalan independence and the implied change in its trade border would affect trade flows, consumer prices, producer prices, and welfare for Catalonia, for the remaining Spanish regions, as well as for the countries worldwide. A prevailing view among Catalan independence supporters is that the economically vibrant Catalonia contributes more to the Spanish state than it receives in return. Data shows that Catalonia is a net contributor of transfers, paying a net 3.8% of its GDP to the Spanish common pool, after adjusting for the total fiscal deficit. To account for fiscal contributions, we incorporate fiscal transfers between the Spanish Autonomous Communities into our model. This allows us to quantify the effects of Catalan independence net of the transfers. In several counterfactual scenarios, we study the trade and welfare effects for the various political possibilities regarding, for instance, Catalan EU and WTO membership.

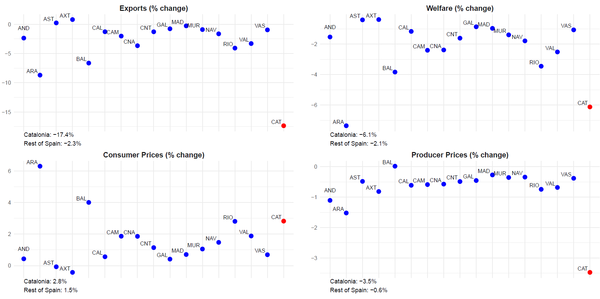

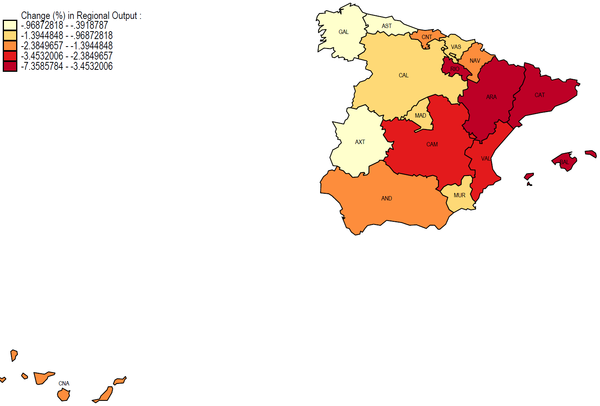

A possible scenario could be that Catalonia remains in the EU, i.e. its regional border becomes as thick as its EU border, and Catalonia no longer contributes to the Spanish fiscal common pool after its independence. Despite the saved fiscal spending, this would imply a drop in Catalan total exports of 17.4% and a welfare loss of 6.1% (see Figure 3). At the same time, Catalan consumers would have to pay more for their products (consumer prices rise by 2.8%), while producers earn less (producer prices fall by 3.5%), so, both consumers and producers share the burden of increased trade costs. Qualitatively, the remaining Spanish regions face the same effects, albeit with a much smaller magnitude. On average, total exports for the rest of Spain would drop by 2.3% and welfare would decrease by 2.1%. The geographical distribution of the welfare losses within Spain in Figure 4 shows that the regions located closer to Catalonia are more impacted than other regions further away. The other countries worldwide only face minimal welfare changes following Catalan independence.

Figure 3: Catalonia’s Regional Border as EU Country Border. Effects on total exports, welfare, consumer prices, and producer prices for Catalonia and the remaining Spanish regions.

Figure 4: Catalonia’s Regional Border as EU Country Border. Geographical distribution of the welfare effects within Spain.

The first scenario may underestimate the effects of Catalan independence, considering that Catalonia may not be granted EU membership. A less integrated scenario could therefore be an independent Catalonia that no longer is a member of the EU, making Catalan exports drop by 48% and welfare decrease by 16.4%. The average effects for the remaining Spanish regions are similar to the previous scenario, with exports and welfare dropping by 3% and 2.6%, respectively.

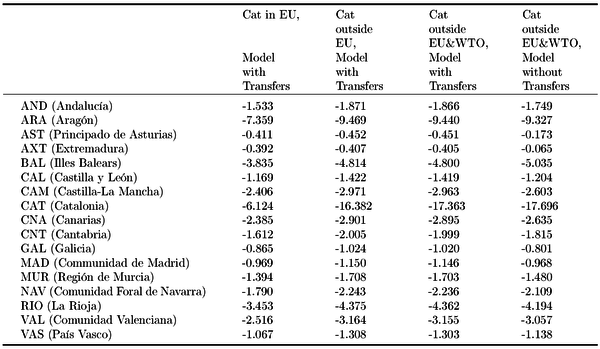

In a worst-case scenario, an independent Catalonia could find itself both outside the EU and the WTO, which would imply a welfare loss of 17.4% for Catalonia. The effects for the remaining Spanish regions are similar to the more integrated scenarios, with the average welfare decrease staying at 2.6%, as in the previous scenario. These results would not change much if the fiscal transfers were not accounted for in our model. Without considering the fiscal contributions, an independent Catalonia outside the EU and WTO would face a welfare loss of 17.7%, while the rest of Spain would face an average drop of 2.4% in welfare. This suggests that the role played by fiscal transfers between the Spanish regions may be not as large as often assumed. Table 1 summarises the welfare effects for all Spanish Autonomous Communities for the different scenarios.

Table 1: Welfare Change (%) for Spanish Regions, Different Counterfactual Scenarios.

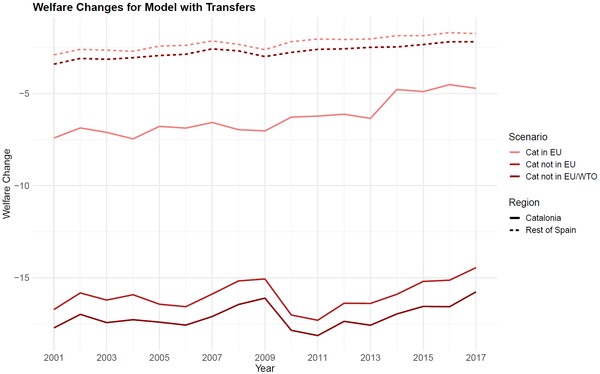

To assess whether the economic costs of independence have changed over time for Catalonia and the remaining Spanish regions, we conduct our three counterfactual experiments yearly during 2001–2017. Figure 5 displays the welfare change for Catalonia and the average of the remaining Spanish regions over time and shows that Catalonia’s cost of independence has decreased in recent years for all scenarios. The welfare losses decreased especially after 2011, consistent with the finding that Catalonia became more integrated internationally, such that the change from a regional border to an international border leads to a weaker increase in trade costs over time.

Our analysis unravels some interesting facts about the political economy of future hypothetical negotiations regarding Catalan independence. For the remaining Spanish Autonomous Communities, the losses associated with Catalan independence are lower and very similar in all scenarios (with both EU-exit scenarios hardly distinguishable), as well as over time. The costs for the remaining Spanish regions are relatively stable and lower than the costs for Catalonia in every scenario that we studied. This disparity suggests a strategic advantage for the Spanish government in hypothetical independence negotiations, as it could leverage economic stability and potentially veto EU membership to influence Catalonia’s costs of secession. Further, we also quantify the impact for the rest of the countries in our sample. The effects are modest but heterogeneous, highlighting the international dimension of a potential Catalan independence.

Figure 5: Change (in %) of Welfare for Catalonia and the Remaining Spanish Regions Over Time for Different Scenarios.

In conclusion, our study highlights the asymmetry in economic impacts between Catalonia and the remaining Spanish regions in potential independence scenarios, offering insights into the economic rationale behind the independence movement. As Catalonia’s trade moved towards international markets during the aftermath of the financial crisis (2008), the projected costs of independence decreased. Despite its increased international integration as well as its saved fiscal spending after independence, Catalonia would face welfare losses, trade reductions, and price increases across all scenarios, especially if excluded from the EU or WTO. Meanwhile, the rest of Spain would experience smaller and relatively stable economic effects regardless of Catalonia’s EU status. This disparity suggests that the Spanish government may hold a strategic advantage, given its comparatively stable economic outlook across scenarios.

References

Adam, H. L., Larch, M., & Paniagua, J. (2023). Spain, Split and Talk: Quantifying Regional Independence. CESifo Working Paper No. 10742.

Anderson, J. E., & van Wincoop, E. (2003). Gravity with Gravitas: A Solution to the Border Puzzle. American Economic Review, 93(1), 170–192.

Comerford, D., Myers, N., & Rodriguez Mora, J. (2014). Aspectos Comerciales y Fiscales Relevantes Para Evaluar las Consecuencias Económicas de una Hipotética Independencia de Cataluña. Revista de Economía Aplicada, XXII(64), 85–130.

Comerford, D., & Rodriguez Mora, J. (2019). The Gains from Economic Integration. Economic Policy, 201–266.

Coughlin, C. C., & Novy, D. (2021). Estimating Border Effects: The Impact of Spatial Aggregation. International Economic Review, 62(4), 1453–1487.

McCallum, J. (1995). National Borders Matter: Canada-U.S. Regional Trade Patterns. The American Economic Review, 85(3), 615–623.

Santamaría, M., Ventura, J., & Yeşilbayraktar, U. (2023). Exploring European Regional Trade. Journal of International Economics.

Document information

Published on 02/03/25

Submitted on 30/10/24

Volume L’economia catalana dins el nou marc geoestratègic global, 2025

Licence: CC BY-NC-SA license

Share this document

Keywords

claim authorship

Are you one of the authors of this document?