| Line 26: | Line 26: | ||

==2 Current status of the study== | ==2 Current status of the study== | ||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

| − | |||

==3 Research objectives== | ==3 Research objectives== | ||

Revision as of 05:34, 29 October 2024

Abstract:The electricity-carbon model is a tool used to analyze the carbon emission situation of the power system and its interrelationships with energy structure, economy, technology, and other factors. It can accurately assess the carbon emission situation of different power generation technologies at various stages and helps the power industry to formulate a scientific and reasonable energy transition strategy, which is of great significance. This study takes 38 ceramic enterprises as research objects, establishes five types of electricity-carbon models, and explores the fitting and prediction accuracy of each model. The results show that: In the calibration based on the univariate primary polynomial linear regression electricity-carbon model of 30 ceramic enterprises, 16 of them have a deviation of less than 5% between predicted and verified emissions; 8 of them have a deviation of 5%-10%, and 6 of them have a deviation of more than 10%.For the univariate quadratic polynomial linear regression electricity-carbon model, out of 32 ceramic enterprises, 9 have a deviation of less than 5% between predicted and verified emissions; 9 have a deviation of 5%-10%, and 14 have a deviation of more than 10%. The average deviation value is 12.88%.The calibration results based on the carbon emissions source decomposition of the electricity-carbon model and the linear regression of a one-dimensional polynomial electricity-carbon model are more or less the same.In the calibration of the linear electricity-carbon model based on multi-source data, for 35 ceramic enterprises, 19 have a deviation within 5% between predicted and verified emissions; 8 have a deviation between 5% and 10%, and 8 have a deviation of more than 10%. The average deviation value is 8.65%.The accuracy of the carbon emissions from various electricity-carbon models was verified, providing a reference for enterprises when choosing electricity-carbon models for accounting.

Key words:ceramic enterprises; carbon emissions;electricity-carbon model;linear fitting;prediction bias

1 Background of the study

2 Current status of the study

3 Research objectives

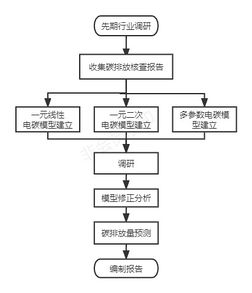

Relying on the technical advantages and experience of the Fujian Metrology Institute in previous carbon emission verification, this paper selects 38 ceramic enterprises in Fujian Province as research objects and establishes enterprise-level electricity-carbon models. By combining multi-source data, we constructed a univariate polynomial linear regression model, a univariate quadratic polynomial linear regression model, and other forms of "multi-data-carbon" models (such as electricity/gas-carbon models). The correlation coefficients of the variables are used to assess the degree of correlation between the independent variable influencing factors and carbon emissions. The technical roadmap is illustrated in Figure 3.1.The enterprise-level electricity-carbon models are validated using the data from the following year. If deviations are found, the reasons are confirmed through multiple methods, such as telephone communication, on-site research, and historical analysis. Corrective parameters are then set for the enterprise-level electricity-carbon models.

4 Content of the study

4.1 Calibration analysis of one-variable polynomial linear regression electricity-carbon model for Fujian ceramics industry

4.1.1 One-variable polynomial linear regression electricity-carbon modeling and corrections

Polynomial regression, a method of regression analysis that examines the polynomials between a dependent variable and one or more independent variables, is called Polynomial Regression. If there is only one independent variable, it is called univariate polynomial regression; if there are more than one independent variables, it is called multivariate polynomial regression [18] , In this study 4.1 uses a univariate polynomial regression equation and 4.2 is a univariate quadratic polynomial regression equation with the formula:

One-variable polynomial regression equations:

|

|

(1) |

One-variable polynomial regression equations:

|

|

(2) |

where Y is the dependent variable.

X is the independent variable.

is the intercept term (the predicted value of Y when X = 0).

is the primary term coefficient, which represents the linear effect of X on Y .

is the quadratic term coefficient, which represents the effect of X 2 on Y .

is the error term, representing random fluctuations not captured by the model.

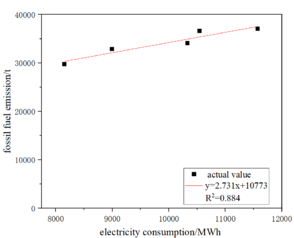

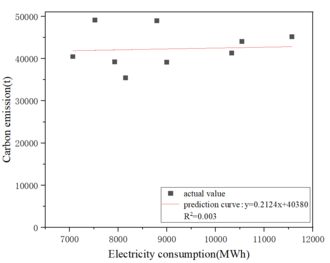

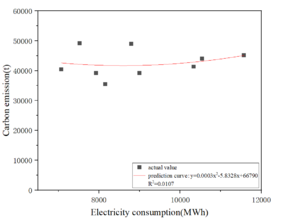

Extract the enterprise's respective corresponding existing historical year to 2020 annual electricity and carbon emissions data, in which the electricity data as the independent variable, carbon emissions data as the dependent variable, to establish a one-dimensional linear electricity and carbon model, and fit the linear curve. Take enterprise 1 as an example, as shown in Figure 4.1.

|

In accordance with the above method to extract the linear correlation coefficients of the fitted curves of 38 enterprises in turn, it was found that the linear relationship between electricity and carbon emissions of 27 enterprises was poor (the correlation coefficient of the degree of linear fit was less than 0.9), and it was considered that the data of the abnormal years should be excluded and re-modeled, and the linear correlation coefficients of the extracted to the 38 enterprises were as shown in Table 4.1.

| company identification | Correlation coefficient (before correction) | Correlation coefficient (corrected) | company identification | Correlation coefficient (before correction) | Correlation coefficient (corrected) |

| Enterprise 1 | 0.003 | 0.9282 | Enterprise 20 | 0.9986 | 0.9986 |

| Enterprise 2 | 0.0445 | 0.7448 | Enterprise 21 | 0.9679 | 0.9679 |

| Enterprise 3 | 0.0387 | 0.6889 | Enterprise 22 | 0.7019 | 0.9753 |

| Enterprise 4 | 0.7297 | 0.9228 | Enterprise 23 | 0.9041 | 0.9041 |

| Enterprise 5 | 0.5215 | 0.8324 | Enterprise 24 | 0.9888 | 0.9888 |

| Enterprise 6 | 0.7892 | 0.9328 | Enterprise 25 | 0.9031 | 0.9031 |

| Enterprise 7 | 0.7071 | 0.9853 | Enterprise 26

|

0.4946 | 0.9753 |

| Enterprise 8 | 0.4306 | 0.9604 | Enterprise 27 | 0.8912 | 0.9957 |

| Enterprise 9 | 0.8508 | 0.9818 | Enterprise 28 | 0.8552 | 0.9417 |

| Enterprise 10 | 0.1104 | 0.8573 | Enterprise 29 | 0.9778 | 0.9778 |

| Enterprise 11 | 0.8539 | 0.8917 | Enterprise 30 | 0.9093 | 0.998 |

| Enterprise 12 | 0.9362 | 0.9362 | Enterprise 31 | 0.5982 | 0.9185 |

| Enterprise 13 | 0.1509 | 0.8729 | Enterprise 32 | 0.3993 | 0.9091 |

| Enterprise 14 | 0.1279 | 0.8348 | Enterprise 33 | 0.4665 | 0.909 |

| Enterprise 15 | 0.7107 | 0.9207 | Enterprise 34 | 0.4304 | 0.8379 |

| Enterprise 16 | 0.965 | 0.9066 | Enterprise 35 | 0.8346 | 0.938 |

| Enterprise 17 | 0.5394 | 0.8607 | Enterprise 36 | 0.752 | 0.9924 |

| Enterprise 18 | 0.9377 | 0.9377 | Enterprise 37 | 0.6411 | 0.9657 |

| Enterprise 19 | 0.9314 | 0.9314 | Enterprise 38 | 0.6567 | 1.0000 |

As can be seen from the table, after the model correction, the linear relationship of the electricity-carbon model of the 38 companies is better (the correlation coefficient of the degree of linear fit is greater than 0.9) for 30 companies (78.9%), with the highest value of 1.000 and the lowest value of 0.6889, and the average value reaches 0.9217.

4.1.2 Calibration of one-variable polynomial linear regression electrocarbon models

Selected 30 enterprises with good linear relationship between electricity and carbon emissions and predictable emissions to carry out electricity-carbon model prediction and verification analysis. Based on the verified electricity data for 2021, the electricity-carbon model predicted the emissions in 2021 and compared the deviation with the actual verified carbon emissions. 16 of the 30 ceramic enterprises had a deviation of less than 5% between the predicted and verified emissions; 8 had a deviation of 5%-10%, and 6 had a deviation of more than 10%, as summarized in Table 4.2.

| sector | Number of linearly fitting firms | Linear fit case | Number of enterprises with forecast deviations | Forecast deviations | ||||||||||

| Better linearity

Correlation coefficient ≥ 0.9 |

Poor linearity

Correlation coefficient <0.9 |

Better forecasts

Prediction deviation ≤10% |

Poor forecasting results

Forecast deviation >10% | |||||||||||

| Mean value of correlation coefficient | Number of enterprises | percentage | Mean value of correlation coefficient | Number of enterprises | percentage | Mean value of forecast deviation | Number of enterprises | percentage | Mean value of forecast deviation | Number of enterprises | percentage | |||

| Ceramics | 38 | 0.9518 | 30 | 78.9% | 0.8246 | 8 | 21.1% | 30 | 3.81% | 24 | 80% | 19.59% | 6 | 20% |

4.2 Calibration analysis of one-quadratic polynomial linear regression electricity-carbon model for Fujian ceramics industry

4.2.1 One-quadratic polynomial linear regression electricity-carbon modeling and corrections

Extract the enterprise's respective corresponding existing historical year to 2020 annual electricity and carbon emissions data, in which the electricity data as the independent variable, carbon emissions data as the dependent variable, the establishment of a one-quadratic polynomial linear regression electricity-carbon model, and fit the linear curve. Take enterprise 1 as an example, as shown in Figure 4.2.

|

The linear correlation coefficients of the fitted curves of the 38 enterprises were extracted sequentially according to the above method, and it was found that the linear relationship between electricity and carbon emissions of 25 enterprises was poor (the correlation coefficient of the degree of linear fit was less than 0.9), and it was considered that the data of the abnormal years would be excluded and then remodeled, and the linear correlation coefficients of the 38 enterprises were extracted as shown in Table 4.3 (the data of enterprise 2, enterprise 3, enterprise 26, and enterprise 38 were available for 3 years only). years of data, no quadratic fitting was performed).

| company identification | Correlation coefficient (before correction) | Correlation coefficient (corrected) | company identification | Correlation coefficient (before correction) | Correlation coefficient (corrected) |

| Enterprise 1 | 0.0107 | 0.9321 | Enterprise 20 | 0.9999 | 0.9999 |

| Enterprise 2 | 0.3718 | / | Enterprise 21 | 0.9833 | 0.9833 |

| Enterprise 3 | 0.1082 | / | Enterprise 22 | 0.7745 | 0.9816 |

| Enterprise 4 | 0.797 | 0.9237 | Enterprise 23 | 0.9081 | 0.9081 |

| Enterprise 5 | 0.6606 | 0.9011 | Enterprise 24 | 0.9907 | 0.9907 |

| Enterprise 6 | 0.7912 | 0.9643 | Enterprise 25 | 0.9057 | 0.9057 |

| Enterprise 7 | 0.9125 | 0.9864 | Enterprise 26 | 0.4968 | / |

| Enterprise 8 | 0.456 | 0.9926 | Enterprise 27 | 0.8922 | 0.999 |

| Enterprise 9 | 0.8512 | 0.9897 | Enterprise 28 | 0.9142 | 0.997 |

| Enterprise 10 | 0.2411 | 0.8858 | Enterprise 29 | 0.9992 | 0.9992 |

| Enterprise 11 | 0.8789 | 0.9937 | Enterprise 30 | 0.9256 | 0.9997 |

| Enterprise 12 | 0.9415 | 0.9415 | Enterprise 31 | 0.6034 | 0.9418 |

| Enterprise 13 | 0.1513 | 0.9999 | Enterprise 32 | 0.7811 | 0.9258 |

| Enterprise 14 | 0.128 | 0.8372 | Enterprise 33 | 0.4715 | 0.9091 |

| Enterprise 15 | 0.81 | 0.952 | Enterprise 34 | 0.6145 | 0.9101 |

| Enterprise 16 | 0.993 | 0.9085 | Enterprise 35 | 0.8685 | 0.9383 |

| Enterprise 17 | 0.8613 | 0.9636 | Enterprise 36 | 0.7693 | 0.9944 |

| Enterprise 18 | 0.9507 | 0.9507 | Enterprise 37 | 0.806 | 0.9678 |

| Enterprise 19 | 0.959 | 0.9259 | Enterprise 38 | 0.7051 | / |

As can be seen from the table, after the model correction, in addition to four companies that could not be corrected for not quadratic fit, the remaining 34 companies have a better linear relationship (the correlation coefficient of the degree of linear fit is greater than 0.9) of the electricity-carbon model of the 32 companies, which accounted for 94.1%, with the highest value of 0.9999, the lowest value of 0.8372, and the average value reaches 0.9529.

4.4.2 One-quadratic polynomial linear regression electrocarbon model calibration

Selected 32 enterprises with good linear relationship between electricity and carbon emissions can predict the emissions to carry out the electricity-carbon model prediction and verification analysis. Based on the verified electricity data for 2021, the emissions in 2021 were predicted by the electricity-carbon model and compared with the deviation of the actual verified carbon emissions. 9 of the 32 ceramic enterprises had a deviation of less than 5% between the predicted emissions and the verified emissions, 9 had a deviation of 5%-10%, and 14 had a deviation of more than 10%, with an average deviation value of 12.88%, as summarized in Table 4.4.

| sector | Number of fitted enterprises | Linear regression fit of a quadratic polynomial in one variable | Number of enterprises with forecast deviations | Forecast deviations | ||||||||||

| Linear regression with a quadratic polynomial fits better

Correlation coefficient ≥ 0.9 |

Poorly fitted linear regression with a quadratic polynomial

Correlation coefficient <0.9 |

Better forecasts

Prediction deviation ≤10% |

Poor forecasting results

Forecast deviation >10% | |||||||||||

| Mean value of correlation coefficient | Number of enterprises | percentage | Mean value of correlation coefficient | Number of enterprises | percentage | Mean value of forecast deviation | Number of enterprises | percentage | Mean value of forecast deviation | Number of enterprises | percentage | |||

| Ceramics | 34 | 0.9887 | 32 | 94.1% | 0.8615 | 2 | 5.9% | 32 | 4.66% | 18 | 56.3% | 23.46% | 14 | 43.7% |

4.3 Calibration analysis of linear electricity-carbon model based on carbon emission source decomposition for ceramic industry

4.3.1 Establishment of a linear electricity-carbon model based on carbon source decomposition

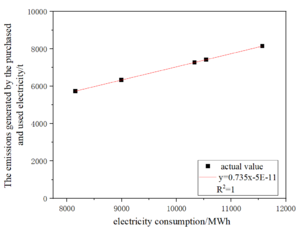

Carbon emission sources in the ceramic industry include: fossil fuel combustion, production process emissions, net purchased use of electricity, and net purchased use of heat. Carbon emissions from each carbon emission source for each historical year of the enterprise and the data of electricity consumption for each historical year are analyzed, taking enterprise 1 as an example, as shown in Figure 4.3.

The fitted correlation coefficients of the coupled mapping of electricity and emissions from each source for the 38 enterprises are obtained sequentially as in Table 4.5.

| company identification | Electricity emissions from net purchased use | Fossil fuel combustion emissions | Production process emissions | Total emissions | company identification | Electricity emissions from net purchased use | Fossil fuel combustion emissions | Production process emissions | Total emissions |

| Enterprise 1 | 1 | 0.884 | / | 0.9282 | Enterprise 20 | 1 | 0.998 | / | 0.9986 |

| Enterprise 2 | 1 | 0.2391 | / | 0.7448 | Enterprise 21 | 1 | 0.9553 | / | 0.9679 |

| Enterprise 3 | 1 | 0.5628 | / | 0.6889 | Enterprise 22 | 1 | 0.9551 | / | 0.9753 |

| Enterprise 4 | 1 | 0.8382 | 0.7393 | 0.9228 | Enterprise 23 | 1 | 0.9015 | 0.0124 | 0.9041 |

| Enterprise 5 | 1 | 0.8384 | 0.9502 | 0.8324 | Enterprise 24 | 1 | 0.9631 | / | 0.99 |

| Enterprise 6 | 1 | 0.9466 | 0.9101 | 0.9328 | Enterprise 25 | 1 | 0.8159 | 0.1325 | 0.9031 |

| Enterprise 7 | 1 | 0.6691 | / | 0.9853 | Enterprise 26 | 1 | 0.887 | / | 0.9753 |

| Enterprise 8 | 1 | 0.9516 | / | 0.9604 | Enterprise 27 | 1 | 0.5111 | / | 0.9957 |

| Enterprise 9 | 1 | 0.9878 | / | 0.9818 | Enterprise 28 | 1 | 0.9012 | 0.0586 | 0.9417 |

| Enterprise 10 | 1 | 0.8321 | / | 0.8573 | Enterprise 29 | 1 | 0.8287 | 0.6362 | 0.9778 |

| Enterprise 11 | 1 | 0.8592 | / | 0.993 | Enterprise 30 | 1 | 0.9967 | / | 0.998 |

| Enterprise 12 | 1 | 0.9329 | 0.1538 | 0.9362 | Enterprise 31 | 1 | 0.8753 | / | 0.9185 |

| Enterprise 13 | 1 | 0.8318 | 0.7098 | 0.8729 | Enterprise 32 | 1 | 0.1744 | / | 0.9091 |

| Enterprise 14 | 1 | 0.9498 | 0.8424 | 0.8348 | Enterprise 33 | 1 | 0.402 | / | 0.909 |

| Enterprise 15 | 1 | 0.6404 | / | 0.9207 | Enterprise 34 | 1 | 0.5565 | / | 0.8379 |

| Enterprise 16 | 1 | 0.9743 | / | 0.9066 | Enterprise 35 | 1 | 0.9026 | / | 0.938 |

| Enterprise 17 | 1 | 0.7839 | / | 0.8607 | Enterprise 36 | 1 | 0.9883 | / | 0.9924 |

| Enterprise 18 | 1 | 0.9039 | / | 0.9377 | Enterprise 37 | 1 | 0.9401 | / | 0.9657 |

| Enterprise 19 | 1 | 0.9387 | / | 0.9055 | Enterprise 38 | 1 | 0.7138 | / | 0.9443 |

By analyzing the correlation coefficients of the coupled mapping fit between electricity and emissions of each emission source, it can be found that if the correlation coefficients of the coupled mapping fit between electricity and emissions of each emission source are high, the correlation coefficients of the coupled mapping fit between electricity and total emissions are also high; the correlation coefficients of the coupled mapping fit between electricity and emissions of the emission sources with a large percentage of carbon emissions have a large effect on the results of the coupled mapping fit between electricity and total emissions and the other way around, it is small, and this also This explains that some enterprises will cause the linear fitting effect of electricity and total emissions to deteriorate due to changes in the production status of some emission sources, thus affecting the prediction bias accuracy of the electricity-carbon model.

4.3.2 Calibration of linear electricity-carbon model based on carbon source decomposition

The coefficients of the coupled mapping fitting function of electricity data and carbon emission data are extracted and summed respectively, resulting in the fitting coefficients of the indirect coupled mapping function of electricity and carbon emissions, from which the fitting equations of the linear electricity-carbon model based on the decomposition of carbon emission sources are obtained as shown in Table 4.6.

| company identification | Σa | Σb | one-dimensional fitted equation | company identification | Σa | Σb | one-dimensional fitted equation |

| Enterprise 1 | 3.0761 | 10754 | y = 3.0761x + 10754 | Enterprise 20 | 4.1572 | 435.98 | y = 4.1572x + 435.98 |

| Enterprise 2 | 0.7784 | 28381 | y = 0.7784x + 28381 | Enterprise 21 | 4.4156 | -1395.9 | y = 4.4156x - 1395.9 |

| Enterprise 3 | 2.9617 | 21224 | y = 2.9617x + 21224 | Enterprise 22 | 2.6376 | 7956.1 | y = 2.6376x + 7956.1 |

| Enterprise 4 | 2.7109 | 19661 | y = 2.7109x + 19661 | Enterprise 23 | 3.1791 | 254.39 | y = 3.1791x + 254.39 |

| Enterprise 5 | 6.9937 | -56682 | y = 6.9937x - 56682 | Enterprise 24 | 1.6091 | -275.43 | y = 1.6091x - 275.43 |

| Enterprise 6 | 4.3428 | -11954 | y = 4.3428x - 11954 | Enterprise 25 | 1.8788 | -3242.4 | y = 1.8788x - 3242.4 |

| Enterprise 7 | 7.0392 | -13624 | y = 7.0392x - 13624 | Enterprise 26 | 0.5512 | 35460 | y = 0.5512x + 35460 |

| Enterprise 8 | 7.1051 | -20265 | y = 7.1051x - 20265 | Enterprise 27 | 0.6593 | 62415 | y = 0.6593x + 62415 |

| Enterprise 9 | 6.9134 | -22856 | y = 6.9134x - 22856 | Enterprise 28 | 2.7325 | 7249.6 | y = 2.7325x + 7249.6 |

| Enterprise 10 | 7.6711 | -21576 | y = 7.6711x - 21576 | Enterprise 29 | 1.8799 | -1716.2 | y = 1.8799x - 1716.2 |

| Enterprise 11 | 5.0651 | -15964 | y = 5.0651x - 15964 | Enterprise 30 | 3.2377 | -49.007 | y = 3.2377x - 49.007 |

| Enterprise 12 | 5.368 | 4001.4 | y = 5.368x + 4001.4 | Enterprise 31 | 3.3286 | 1682.3 | y = 3.3286x + 1682.3 |

| Enterprise 13 | 4.4572 | -6283.2 | y = 4.4572x - 6283.2 | Enterprise 32 | 0.8232 | 24770 | y = 0.8232x + 24770 |

| Enterprise 14 | 0.3976 | 73120 | y = 0.3976x + 73120 | Enterprise 33 | 3.1803 | 3360.7 | y = 3.1803x + 3360.7 |

| Enterprise 15 | 3.4854 | 5812.8 | y = 3.4854x + 5812.8 | Enterprise 34 | 1.3597 | 13302 | y = 1.3597x + 13302 |

| Enterprise 16 | 3.6071 | -14.172 | y = 3.6071x - 14.172 | Enterprise 35 | 3.2349 | -2101.9 | y = 3.2349x - 2101.9 |

| Enterprise 17 | 2.5361 | 5347.8 | y = 2.5361x + 5347.8 | Enterprise 36 | 3.5902 | -1595.2 | y = 3.5902x - 1595.2 |

| Enterprise 18 | 3.4581 | -1254.2 | y = 3.4581x - 1254.2 | Enterprise 37 | 2.6712 | 2391 | y = 2.6712x + 2391 |

| Enterprise 19 | 3.1993 | 467.58 | y = 3.1993x + 467.58 | Enterprise 38 | 4.3805 | 14245 | y = 4.3805x + 14245 |

Through comparison, it is found that the fitting equations of the linear electricity-carbon model based on the decomposition of carbon emission sources are consistent with the one-dimensional linear fitting equations of the direct coupling of electricity-carbon , which is mainly due to the fact that the independent variables of each linear equation based on the decomposition of carbon emission sources are all the data of electricity, and the use of the direct cumulative is in fact to add up the slopes and the intercepts of the individual linear equations correspondingly, and the final obtained fitting equations of the linear electricity-carbon model based on the decomposition of carbon emission sources are consistent with the one-dimensional linear fitting equations of the direct coupling of electricity-carbon . The resulting linear electricity-carbon model based on carbon emission source decomposition is consistent with the one-dimensional linear fitting equation for the direct coupling of electricity-carbon .

4.4 Calibration Analysis of Linear electricity-carbon model Based on Production Correlation Volume for Fujian Ceramics Industry

4.4.1 Linear electricity-carbon modeling of Ceramic Firms Based on Production Linkage Quantities

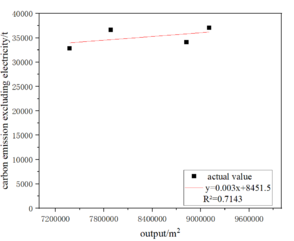

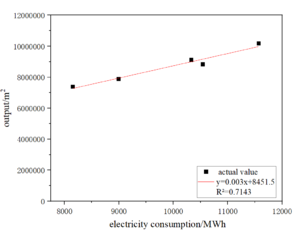

Establish the net purchased electricity generated carbon emissions and electricity data of the fitting relationship equation and deducted from the electricity indirect emissions of other carbon emissions and electricity data of the fitting relationship equation, which in addition to electricity emissions of other carbon emissions and electricity data of the fitting relationship equation through the intermediate amount of data (ceramics production) to establish the relationship between the electricity data and the carbon emissions data, respectively, to obtain the fitting coefficients of the two parts of the fitted model fitting coefficients. The fitting coefficients are added together to obtain the fitting function of the total carbon emissions data and electricity data. Take Enterprise 1 as an example in Figure 4.4.

|

|

| Figure 4.4-1 The linear relationship between output and carbon emission excluding electricity | Figure 4.4-2 The linear relationship between electricity consumption and output |

| company identification | Electricity-electricity-carbon emissions correlation coefficient | Electricity - ceramic production

correlation coefficient |

Correlation coefficient for ceramic production - carbon emissions from de-electricity | company identification | Electricity-electricity-carbon emissions correlation coefficient | Electricity - ceramic production

correlation coefficient |

Correlation coefficient for ceramic production - carbon emissions from de-electricity |

| Enterprise 1 | 1 | 0.7143 | 0.95 | Enterprise 20 | 1 | 0.9925 | 0.9877 |

| Enterprise 2 | 1 | 0.2931 | 0.4012 | Enterprise 21 | 1 | 0.9256 | 0.9151 |

| Enterprise 3 | 1 | 0.7996 | 0.9348 | Enterprise 22 | 1 | 0.9879 | 0.9989 |

| Enterprise 4 | 1 | 0.8327 | 0.9673 | Enterprise 23 | 1 | 0.9783 | 0.8178 |

| Enterprise 5 | 1 | 0.1232 | 0.1525 | Enterprise 24 | 1 | 0.6232 | 0.2041 |

| Enterprise 6 | 1 | 0.7041 | 0.7507 | Enterprise 25 | 1 | 0.6722 | 0.5647 |

| Enterprise 7 | 1 | 0.7949 | 0.9319 | Enterprise 26 | 1 | 0.7241 | 0.1265 |

| Enterprise 8 | 1 | 0.8911 | 0.8049 | Enterprise 27 | 1 | 0.9749 | 0.8616 |

| Enterprise 9 | 1 | 0.9332 | 0.9797 | Enterprise 28 | 1 | 0.7961 | 0.9536 |

| Enterprise 10 | 1 | 0.9984 | 0.875 | Enterprise 29 | 1 | 0.9655 | 0.9293 |

| Enterprise 11 | 1 | 0.9352 | 0.9595 | Enterprise 30 | 1 | 0.9862 | 0.9497 |

| Enterprise 12 | 1 | 0.8126 | 0.6578 | Enterprise 31 | 1 | 0.0653 | 0.03152 |

| Enterprise 13 | 1 | 0.8392 | 0.6538 | Enterprise 32 | 1 | 0.3088 | 0.6808 |

| Enterprise 14 | 1 | 0.0055 | 0.3605 | Enterprise 33 | 1 | 0.9757 | 0.5606 |

| Enterprise 15 | 1 | 0.9788 | 0.6477 | Enterprise 34 | 1 | 0.86 | 0.8767 |

| Enterprise 16 | 1 | 0.9871 | 0.9214 | Enterprise 35 | 1 | 0.9013 | 0.9411 |

| Enterprise 17 | 1 | 0.8661 | 0.7496 | Enterprise 36 | 1 | 0.9998 | 0.986 |

| Enterprise 18 | 1 | 0.9489 | 0.9001 | Enterprise 37 | 1 | 0.7864 | 0.717 |

| Enterprise 19 | 1 | 0.9525 | 0.9717 | Enterprise 38 | 1 | 0.8988 | 0.8986 |

As can be seen from the table, the 38 companies based on the amount of production linkage of the coupled mapping fitted a better linear relationship (the correlation coefficient of the degree of linear fit is greater than 0.9) there are 12 companies, accounting for 63.6% of the total number of companies.

| company identification | fitting factor | (math.) simultaneous equations | company identification | fitting factor | (math.) simultaneous equations | ||

| a | b | a | b | ||||

| Enterprise 9 | 6.6717 | -19327.1 | y=6.6717x-

19327.1 |

Enterprise 21 | 4.182456 | -241.0406 | y=4.182456x-

241.0406 |

| Enterprise 11 | 5.608158 | -17873 | y=5.608158x-

17873 |

Enterprise 22 | 2.491884 | 8718.5992 | y=2.491884x+

8718.5992 |

| Enterprise 16 | 2.82915 | 8757 | y=2.82915x+

8757 |

Enterprise 29 | 1.8495762 | -1299.5654 | y=1.8495762x-1299.5654 |

| Enterprise 18 | 3.3891 | -1271.357 | y=3.3891x-

1271.357 |

Enterprise 30 | 4.397316 | -14775.8 | y=4.397316x-

14775.8 |

| Enterprise 19 | 3.285485 | -338.572 | y=3.285485x-

338.572 |

Enterprise 35 | 3.186538 | -1205.727 | y=3.186538x-

1205.727 |

| Enterprise 20 | 4.110577 | 565.4129 | y=4.110577x+

565.4129 |

Enterprise 36 | 3.720592 | -1979.4748 | y=3.720592x-

1979.4748 |

4.4.2 Calibration of Linear Electrocarbon Model for Ceramic Firms Based on Production Correlation Quantities

Based on the annual electricity data of 2021, the emissions in 2021 were predicted by the electricity-carbon model and compared with the deviation of the actual verified carbon emissions. 6 of the 12 ceramic enterprises had a deviation of less than 5% between the predicted emissions and the verified emissions; 3 had a deviation of 5%-10% and 3 had a deviation of more than 10%, with an average value of the deviation of 9.37%.

| sector | Number of linearly fitting firms | Linear fit case | Number of enterprises with forecast deviations | Forecast deviations | ||||||||||

| Better linearity

Correlation coefficient ≥ 0.9 |

Poor linearity

Correlation coefficient <0.9 |

Better forecasts

Prediction deviation ≤10% |

Poor forecasting results

Forecast deviation >10% | |||||||||||

| Mean value of correlation coefficient | Number of enterprises | percentage | Mean value of correlation coefficient | Number of enterprises | percentage | Mean value of forecast deviation | Number of enterprises | percentage | Mean value of forecast deviation | Number of enterprises | percentage | |||

| Ceramics | 38 | 0.9564 | 12 | 31.6% | 0.682 | 26 | 68.4% | 12 | 3.70% | 9 | 75.00% | 26.39% | 3 | 25.00% |

4.5 Multi-source linear electricity-carbon model calibration analysis for ceramic industry

4.5.1 Establishment and Modification of a Multi-source Linear Electrocarbon Model for Ceramic Firms

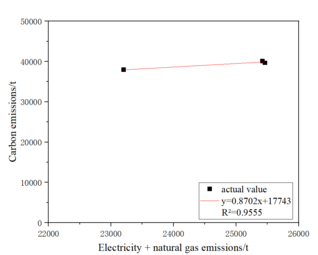

The ceramic enterprises will be corresponding to the existing historical years to 2020 years of electricity and natural gas to calculate carbon emissions, and then with the total emissions to establish "electricity - natural gas - carbon emissions" multi-parameter electricity-carbon model and fit a linear curve, to enterprise 2 as an example of Figure 4.5.

|

| Figure 4.5 The linear fitting curve of the multi-parameter electricity-carbon model of enterprise 2 |

The correlation coefficients for the degree of linear fit were found to be greater than 0.9 for seven enterprises. The data of abnormal years were considered for re-modeling after elimination, of which enterprise 1 and enterprise 38 could not be corrected due to changes in natural gas consumption over the years, and the remaining 29 enterprises with multi-parameter electricity-carbon models fitted linear curves to obtain the correlation coefficients as shown in the table below.

| company identification | Correlation coefficient (before correction) | Correlation coefficient (corrected) | company identification | Correlation coefficient (before correction) | Correlation coefficient (corrected) |

| Enterprise 1 | 0.2067 | / | Enterprise 20 | 0.9987 | 0.9987 |

| Enterprise 2 | 0.414 | 0.9555 | Enterprise 21 | 0.9958 | 0.9958 |

| Enterprise 3 | 0.3336 | 0.9927 | Enterprise 22 | 0.9736 | 0.9268 |

| Enterprise 4 | 0.3472 | 0.9714 | Enterprise 23 | 0.8919 | 0.9963 |

| Enterprise 5 | 0.6209 | 0.9955 | Enterprise 24 | 1 | 1 |

| Enterprise 6 | 0.149 | 0.9073 | Enterprise 25 | 0.893 | 0.9045 |

| Enterprise 7 | 0.7376 | 0.9897 | Enterprise 26 | 0.7943 | 0.9836 |

| Enterprise 8 | 0.6767 | 0.9814 | Enterprise 27 | 0.8912 | 0.9957 |

| Enterprise 9 | 0.044 | 0.986 | Enterprise 28 | 0.0683 | 0.9786 |

| Enterprise 10 | 0.3339 | 0.9733 | Enterprise 29 | 0.9121 | 0.9121 |

| Enterprise 11 | 0.0946 | 0.9999 | Enterprise 30 | 0.6901 | 0.9165 |

| Enterprise 12 | 0.3745 | 0.9414 | Enterprise 31 | 0.8529 | 0.9617 |

| Enterprise 13 | 0.062 | 0.9935 | Enterprise 32 | 0.3416 | 0.9923 |

| Enterprise 14 | 0.5615 | 0.7894 | Enterprise 33 | 0.3785 | 0.9384 |

| Enterprise 15 | 0.4109 | 0.9949 | Enterprise 34 | 0.9439 | 0.9407 |

| Enterprise 16 | 0.7401 | 0.9844 | Enterprise 35 | 0.0716 | 0.9274 |

| Enterprise 17 | 0.0721 | 0.9362 | Enterprise 36 | 0.7799 | 0.9686 |

| Enterprise 18 | 0.9849 | 0.9849 | Enterprise 37 | 0.3354 | 0.9899 |

| Enterprise 19 | 0.5464 | 0.9751 | Enterprise 38 | 0.0647 | / |

As can be seen from the table, except for 2 enterprises that could not be corrected, the rest of the enterprises have been corrected by the model, and the linear relationship of the electricity-carbon model of 36 enterprises is better (the correlation coefficient of the degree of linear fit is greater than 0.9) there are 35 enterprises, which accounts for 97.2% of the total number of enterprises, with the highest value of 1.000, the lowest value of 0.7894, and the average value reaches 0.9633.

4.5.2 Multi-source linear electricity-carbon model calibration for ceramic firms

Thirty-five enterprises with good linear relationship between multi-parameter electric carbon and predictable emissions were selected to carry out electricity-carbon model prediction and verification analysis. Based on the verified electricity data of 2021, the emissions in 2021 were predicted by multi-parameter electric carbon and compared with the deviation of the actual verified carbon emissions. 19 of the 35 ceramic enterprises had a deviation of less than 5% between the predicted emissions and the verified emissions, 8 had a deviation of 5%-10%, and 8 had a deviation of more than 10%, with an average value of deviation of 8.65%.

| sector | Number of linearly fitting firms | Multi-parameter linear fitting case | Number of enterprises with forecast deviations | Forecast deviations | ||||||||||

| Better linear fit

Correlation coefficient ≥ 0.9 |

Poor linear fit

Correlation coefficient <0.9 |

Better forecasts

Prediction deviation ≤10% |

Poor forecasting results

Forecast deviation >10% | |||||||||||

| Mean value of correlation coefficient | Number of enterprises | percentage | Mean value of correlation coefficient | Number of enterprises | percentage | Mean value of forecast deviation | Number of enterprises | percentage | Mean value of forecast deviation | Number of enterprises | percentage | |||

| Ceramics | 36 | 0.9683 | 35 | 97.1% | 0.7894 | 1 | 2.9% | 35 | 3.56% | 27 | 77.1% | 25.84% | 8 | 22.9% |

V. Conclusion

A horizontal comparison of different electricity-carbon model calibration methods is made. According to the order of testing methods, the calibration of the linear regression electricity-carbon model with a one-variable polynomial is method 1, the calibration of the linear regression electricity-carbon model with a one-variable quadratic polynomial is method 2, the calibration of the electricity-carbon model based on the decomposition of the carbon emission sources is method 3, the calibration of the linear electricity-carbon model based on the production correlation quantity is method 4, and the calibration of the linear electricity-carbon model based on the multi-source data is method 5. The main analyzed data of each calibration method is shown in the table below.

| sector | Good linearity of electrocarbon model fit (correlation coefficient ≥ 0.9)

Mean value of correlation coefficient |

Better forecasts (forecast deviation ≤10%)

Mean value of forecast deviation | ||||||||

| Method 1 | Method 2 | Method 3 | Method 4 | Method 5 | Method 1 | Method 2 | Method 3 | Method 4 | Method 5 | |

| Ceramics | 0.9518 | 0.9587 | 0.9518 | 0.9564 | 0.9683 | 3.81% | 4.66% | 3.81% | 3.70% | 3.56% |

Through comparison, it is found that, using the simplest method 1 as the benchmark, the fitted linearity of the electricity-carbon model established by method 2 is not significantly improved, and the prediction deviation is only reduced in the paper-making industry; method 3 is consistent with the essence of method 1, and the results of the fitted linearity and the prediction deviation results are the same as those of method 1, but the method has a certain degree of interpretativeness; method 4 establishes a certain improvement of fitted linearity of the electricity-carbon model compared with method 1; method 5 establishes a certain improvement of the electricity-carbon model fit linearity compared with method 1, and the prediction deviation is reduced. The fitted linearity of the electricity-carbon model established by Method 4 is somewhat improved compared with Method 1; the fitted linearity of the electricity-carbon model established by Method 5 is somewhat improved compared with Method 1, and the prediction deviation is somewhat reduced, which is mainly due to the fact that the method introduces other emission source data, which is conducive to increasing the proportion of the independent variable in the electricity-carbon model, and reducing the impact of power emission fluctuations on linearity. It can be seen that Method 5 is a better solution for the calibration of the electricity-carbon model.

In terms of the difficulty of obtaining data related to carbon emissions, Methods 1 and 2 are the easiest, requiring only electricity and total emissions data; Method 3 is the most difficult, but the calibration results are consistent with Method 1, but Method 3 can be used to analyze and explain the reasons for the poor linearity of the electricity-carbon model and the large prediction bias in some enterprises; Methods 4 and 5, in addition to electricity and total emissions data, need to be combined with the industry's actual situation, to obtain the data of production-related quantities or other emission sources. In addition to electricity and total emissions data, Methods 4 and 5 need to take into account the actual situation of the industry and obtain data on production-related quantities or other emission sources. The difficulty of obtaining data is general, and the production data is more difficult to obtain than the emission source data, because some of the data on production-related quantities (e.g., production output, etc.) may be obtained through statistics or calculations, and internal confidentiality may be involved. The degree of difficulty in obtaining data from each method: Method 1 = Method 2 < Method 5 < Method 4 < Method 3. Meanwhile, for enterprises with large deviations in prediction, through on-site research and comprehensive analysis of historical verification, the main reasons are consistent with the reasons for the poor linear relationship, i.e., first, changes in the production situation, such as a longer period of shutdowns, intermittent production, the addition or subtraction of production lines, and so on; and second, changes in production processes, such as the type or specification of the products produced, such as the type or specification of the products produced. The second is changes in the production process, such as large changes in the types or specifications of the products produced, and changes in energy consumption due to major technological reforms.

Acknowledgements

This work was supported by Sub-project of National Key Research and Development Projects of China(Grant No. 2022YFF0606404)), and Competitive Projects for Public Welfare of Fujian Provincial Department of Science and Technology(Grant No. 2024R1051)).

References

[1] Jindu, Liu Xinping, China's energy structure transition: carbon emission reduction effects, drivers, and carbon peaking exploration, Journal of Safety and Environment (n.d.) 1-8. https://doi.org/10.13637/j.issn.1009-6094.2024.0074.

[2] H. Li, Y. Su, C.J. Ding, G.G. Tian, Z. Wu, Unveiling the green innovation paradox: Exploring the impact of carbon emission reduction on corporate green technology innovation, Technological Forecasting and Social Change 207 (2024) 123562. https://doi.org/10.1016/j.techfore.2024.123562.

[3] X. Xia, X. Zeng, Z. Wang, J. Chen, Y. Cheng, Carbon tax for energy-intensive enterprises: a study on carbon emission reduction strategies, Expert Systems with Applications 257 (2024) 125011. https://doi.org/10.1016/j.eswa.2024.125011.

[4] Z. Zhang, F. Zhang, C. Ma, Does carbon emission trading scheme inhibit corporate executives' pursuit of excess compensation? from a quasi-natural experiment in China, Energy Economics 139 (2024) 107870. https://doi.org/10.1016/j.eneco.2024.107870.

[5] Y. Xia, G. Sun, Y. Wang, Q. Yang, Q. Wang, S. Ba, A novel carbon emission estimation method based on electricity-carbon nexus and non intrusive load monitoring, Applied Energy 360 (2024) 122773. https://doi.org/10.1016/j.apenergy.2024.122773.

[6] D. Wang, J. Gan, J. Mao, F. Chen, L. Yu, Forecasting power demand in China with a CNN-LSTM model including multimodal information, Energy 263 (2023) 126012. https://doi.org/10.1016/j.energy.2022.126012.

[7] Near-Real-Time Carbon Emission Accounting Technology Toward Carbon Neutrality, Engineering 14 (2022) 44-51. https://doi.org/ 10.1016/j.eng.2021.12.019.

[8] H. Chen, S. Wang, J. Li, Y. Yu, D. Li, L. Jin, Y. Guo, X. Cui, A tracking control method for electricity-carbon emission forecasting, Heliyon 10 (2024) e36576. https://doi.org/10.1016/j.heliyon.2024.e36576.

[9] J. Li, C. Zhang, M.R. Davidson, X. Lu, Assessing the synergies of flexibly-operated carbon capture power plants with variable renewable energy in large-scale power systems, Applied Energy 377 (2025) 124459. https://doi.org/10.1016/j.apenergy.2024.124459.

[10] F. Rosner, T. Bhagde, D.S. Slaughter, V. Zorba, J. Stokes-Draut, Techno-economic and carbon dioxide emission assessment of carbon black production, Journal of Cleaner Production 436 (2024) 140224. https://doi.org/10.1016/j.jclepro.2023.140224.

[11] C. Li, N. Shah, Z. Li, P. Liu, Decoupling framework for large-scale energy systems simultaneously addressing carbon emissions and energy flow relationships through sector units: A case study on uncertainty in China's carbon emission targets, Computers & Chemical relationships through sector units: a case study on uncertainty in China's carbon emission targets, Computers & Chemical Engineering 191 (2024) 108840. https://doi.org/10.1016/j.compchemeng.2024.108840.

[12] J. Lotze, M. Moser, G. Savvidis, D. Keles, V. Hagenmeyer, The complementary role of energy system and power grid models: an analysis of the European energy transformation from a holistic perspective, Energy Conversion and Management 315 (2024) 118761. https://doi.org/10.1016/j.enconman.2024. 118761.

[13] Xie Di, Tian Yinglin, Wang Guangqian, Li Tiejian, Zhong Deyu, Research on Carbon Neutral Pathways and Realization Ways in Qinghai Province, Journal of Applied Basic and Engineering Sciences 30 (2022) 1331-1345. https://doi.org/10.16058/j.issn.1005-0930.2022.06.001.

[14] Qigeng Li, Zijin Ji, Hongchao Zhang, Research on the spatio-temporal evolution law of coordinated development of EES in coal mining subsidence area in Shanxi Province, Mining Safety and Environmental Protection (n.d.) 1-7. https://doi.org/10.19835/j.issn.1008-4495.2021.06.023.

[15] Yuheng Ma, Study on the Peak Carbon Emission Pathway in Northeast China in 2030, M.S., Jilin University, 2019. https://kns.cnki.net/kcms2/article/abstract?v=0-LBHIej7QlIw-scoIpCaRgQAwd8uBpjmmWlepxXgKW0bD_ YQf-spfVLcunPm9EgHyLIj4oT82tSVaeVnHo--xkyYiX6lqACkQfPa2Nkn6gjhT0PjKeumdLd_tkRJN5YFulys4gRJc2rAjzjeIFWDDlpYfqvFN1jOVlrC65_ Exu6UR7vEDW3RKMP6XHlH3Ib9u2f11sG6lM=&uniplatform=NZKPT&language=CHS (accessed October 21, 2024).

[16] Chen Maling, State Grid Fujian Xiamen Power Supply Company: "Modularization 2.0" Sponge Substation Completed, China Power Enterprise Management (2024) 96.

[17] Zhoushan, Zhejiang: PV project on grid to help islands achieve "double carbon" goal, Rural Electrification (2021) 59.

[18] B. Lyu, J. Li, Multiple-model polynomial regression and efficient algorithms for data analysis, Theoretical Computer Science 1021 (2024) 114878. https://doi.org/10.1016/j.tcs.2024.114878.

Document information

Published on 05/11/24

Submitted on 29/10/24

Licence: CC BY-NC-SA license

Share this document

claim authorship

Are you one of the authors of this document?